World Bank Salary: A Guide to Tiers and Benefits

A World Bank salary is a different beast. It’s a competitive, net-of-tax package designed to pull in top talent from around the globe. The entire system is built on a formal grade structure, starting from GA (entry-level) and going up to GK (senior leadership).

To give you a real-world anchor, a mid-career professional at the common GF grade can expect a net salary between $95,000 and $140,000. And that’s before you get to the hefty benefits package.

Breaking Down World Bank Compensation

The World Bank builds a comprehensive package. Think of it as three core pillars supporting a financially attractive career.

First, you have the net base salary, the headline number tied to your grade. This is the foundation of your earnings, and for most international staff, it’s paid without tax deductions. The average salary at the World Bank is reportedly around $134,000 per year, with most packages landing between $112,000 and $194,000.

Next are the extensive benefits. These are substantive offerings designed to provide real security for you and your family.

Finally, a suite of allowances covers the unique costs of being part of an international workforce, especially for those relocating. These funds handle the practicalities of moving, housing, and educating your children.

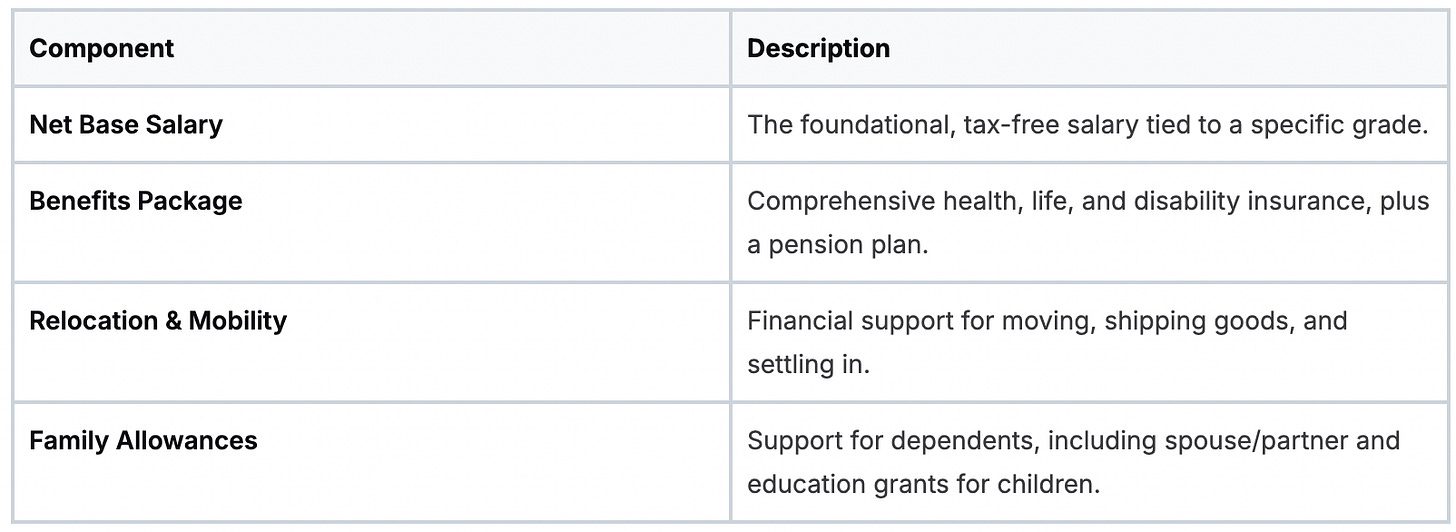

Here’s a quick summary of the key components you’ll find in a typical offer.

As you can see, the final offer is much more than a single number. It’s a carefully constructed package.

What Your Offer Truly Includes

A World Bank offer is a collection of components that add up to serious financial security. You have to understand each piece to grasp the true value of a potential role.

Here’s a quick rundown of what’s on the table:

Tax-Free Net Salary: Your base pay is a net amount, a huge feature we’ll detail later.

Comprehensive Insurance: This means full medical, dental, life, and disability coverage.

Staff Retirement Plan: A highly-regarded pension plan that provides long-term financial stability.

Relocation and Mobility Benefits: Financial help for moving your life, shipping personal effects, and getting settled in a new duty station.

Family and Dependent Allowances: Extra financial support for spouses, domestic partners, and children, which includes a generous education allowance.

This structure is designed so staff can focus on their mission-driven work without the financial stress of an international career. If you’re curious how this stacks up against similar organizations, check out our deep dive into the numbers behind multilateral development bank salaries.

Decoding the World Bank Salary Grades

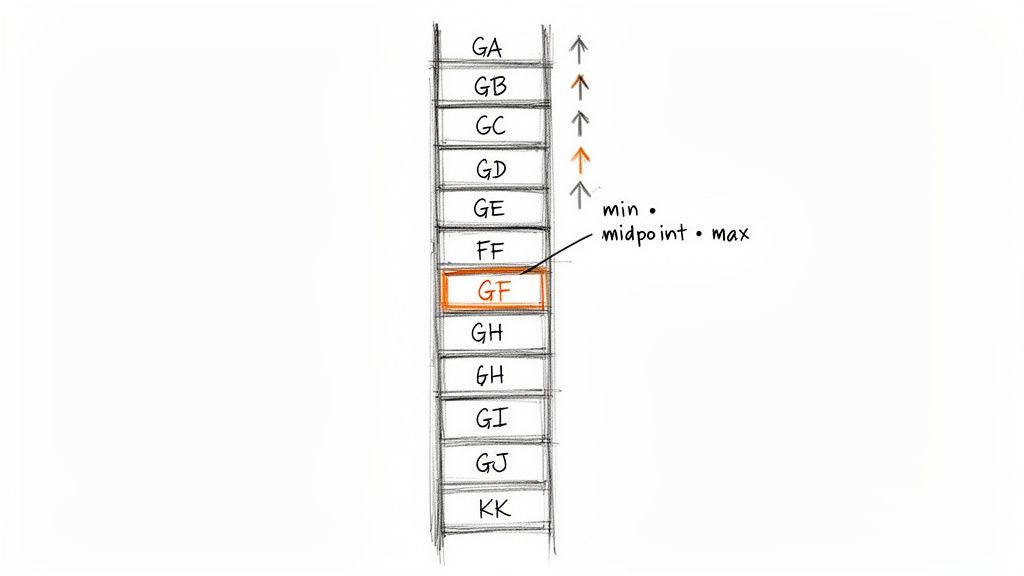

Your salary at the World Bank isn’t an arbitrary number. It’s the output of a structured system that ties every role to a specific pay grade, mapping directly to your level of responsibility and experience. This framework is the bedrock of the Bank’s compensation philosophy.

Every professional staff job is assigned a grade, from GA for entry-level administrative roles up to GK for senior management. You can think of it as a career ladder where each rung represents a clear step up in scope and pay.

For most professional roles, you’ll constantly see three grades: GE, GF, and GG. These are the heart of the Bank’s operational and technical workforce, covering specialists, project managers, and mid-level experts. The GF grade, in particular, is the benchmark for a seasoned, mid-career professional.

The Role of Salary Bands

Attached to each grade is a salary band. This is a range with a clear minimum, midpoint, and maximum. This gives the Bank flexibility to make offers that reflect a candidate’s specific background while keeping everyone at the same responsibility level within a consistent pay scale.

The midpoint of the salary band is the number to watch. It represents the target salary for a fully competent professional who meets all the job requirements. Most new hires are brought in somewhere between the minimum and this midpoint.

Where you land in that range depends on a few key things:

Your experience: How many years of directly relevant work do you have?

Your qualifications: Do you bring specialized skills or an advanced degree that goes beyond the basic requirements?

The role’s demands: Is this a niche position requiring a hard-to-find skillset?

Internal equity: How does your proposed salary stack up against current employees at the same grade with a similar profile?

This system ensures consistency. Two people holding GF-grade jobs might have different salaries, but both are paid within the same established framework for that level.

Identifying the Grade in a Job Posting

When you’re browsing World Bank job openings, finding the grade is easy. It’s listed in the job details. Look for a label like “Grade” or “Term Duration/Grade,” followed by a two-letter code, such as GF.

This code is the most critical piece of information for decoding the seniority and potential salary of a role. It tells you instantly where the job sits in the Bank’s hierarchy.

A GE role is an entry point for professionals, usually requiring a master’s degree and a few years of experience. A GG position is a senior role that involves leading teams or managing complex projects. Move up to a GH level, and you’re looking at significant managerial or top-tier advisory responsibility.

Promotions at the World Bank mean moving up to the next grade. This jump always comes with a substantial pay increase because you’re moving into an entirely new, higher salary band. For a deeper dive into how this plays out for economists, check out our complete World Bank economist salary guide.

Getting a handle on this grading system is crucial. It gives you the power to accurately size up job opportunities, compare different roles, and walk into salary negotiations with a real understanding of the compensation landscape. It’s the language of career progression at the Bank.

Understanding Your Full Compensation Package

A World Bank offer is much more than the base salary. If you’re only looking at the net pay, you’re missing a massive part of the picture. The real value is in the total compensation, boosted by a full suite of allowances and benefits designed to support an international career.

These are substantial financial benefits that can easily add tens of thousands of dollars to your overall package. Understanding how they work is critical to knowing what the World Bank is truly offering.

Allowances for International Staff

For anyone relocating, the World Bank provides a comprehensive set of allowances to take the financial sting out of a major international move. They’re designed to get you, your family, and your life set up in a new country with minimal friction.

The main allowances you’ll see are:

Relocation Grant: A one-time, lump-sum payment to cover initial costs when you land at your new duty station. It’s cash to handle temporary housing, setting up utilities, and other settling-in expenses.

Shipping Allowance: This covers the cost of shipping your personal belongings and household goods. The amount depends on your family size and moving distance, ensuring you can bring what you need to set up a home.

Mobility Premium: For certain internationally recruited staff, a mobility premium is sometimes offered. It’s an incentive to encourage service in different locations, acknowledging the adjustments that come with it.

These allowances are practical. They provide direct financial support that removes the immediate out-of-pocket stress of starting a job in a new country, letting you focus on your new role from day one.

Family and Education Support

The World Bank gets it: an international career often means moving your entire family. The allowance structure is built with this reality in mind, with specific benefits aimed at dependents and your children’s schooling.

The Dependency and Education Allowances are game-changers for staff with families. They represent a huge, non-salary financial benefit that directly tackles two of the biggest expenses of an expatriate lifestyle.

Here are the two big family-focused allowances:

Dependency Allowance: An annual allowance paid for a dependent spouse or domestic partner, and for each dependent child. It’s extra financial support that acknowledges the costs of supporting a family.

Education Allowance: This is a major benefit. It covers a huge portion of education costs for your kids, from kindergarten through secondary school. It’s designed to help staff afford quality private or international schools. There’s also an education travel grant for kids attending school away from your duty station.

These family-oriented benefits make a World Bank career sustainable for professionals with children by directly offsetting major household costs.

The Benefits Package Deconstructed

Beyond the allowances, the core benefits package provides a rock-solid foundation of security and long-term financial planning. This is where the World Bank sets itself apart as a top-tier employer.

The benefits are comprehensive and built for a global workforce:

Medical and Dental Insurance: The Bank offers a robust, worldwide health insurance plan that covers you and your eligible family members. It provides excellent coverage for medical, dental, and vision care, no matter where you are.

Life and Disability Insurance: All staff are automatically enrolled in basic life and disability insurance plans at no cost. You can also buy supplemental coverage for extra security.

Staff Retirement Plan: This is one of the most prized benefits. The World Bank offers a defined benefit pension plan, a rare and valuable retirement vehicle. Both you and the Bank contribute, and it provides a secure income stream for life after your career ends.

When you add it all up, the total compensation for a World Bank position becomes exceptionally competitive. The entire structure is built for stability, security, and long-term success.

How Your Net Take-Home Pay Is Calculated

One of the best, and most misunderstood, perks of a World Bank job is the net-of-tax salary. For most international staff, it’s refreshingly simple: the number on your offer letter is what you actually get. No income tax is deducted.

This is a massive advantage that supercharges your real take-home pay compared to a similar-sounding salary in the private sector.

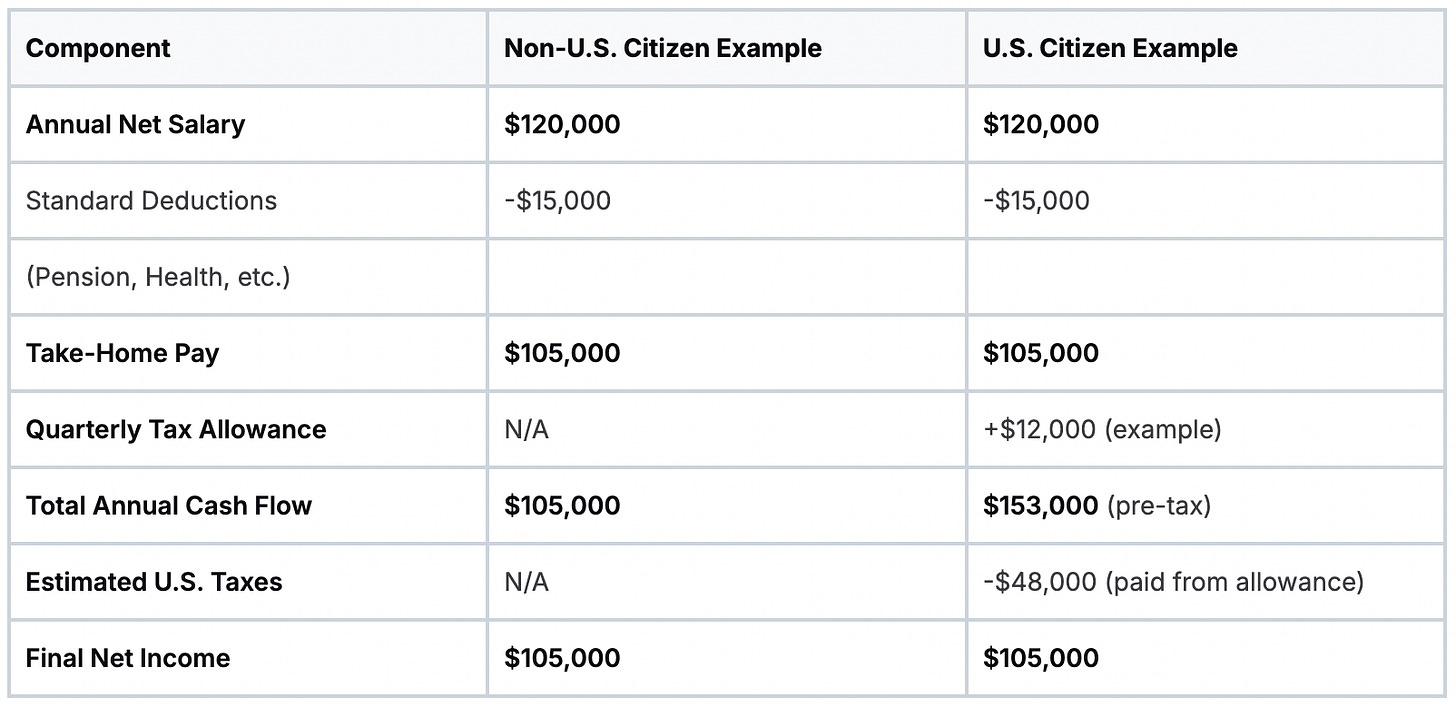

For U.S. citizens and permanent residents, there’s an extra step. Because the U.S. government taxes its citizens on worldwide income, the World Bank levels the playing field with a tax allowance. This is an additional, quarterly payment designed to cover your estimated U.S. federal, state, and local taxes on your Bank earnings.

The goal is to ensure that after all tax paperwork is filed, a U.S. staff member’s net income is in line with their non-U.S. colleague at the same grade. It’s a core part of the Bank’s philosophy of maintaining fairness across its diverse workforce. For a deeper dive into the mechanics, check out our guide on why MDB employees often pay no taxes.

The “Net Pay” Advantage for Non-U.S. Staff

If you’re not a U.S. citizen, calculating your take-home pay is incredibly straightforward. Your net salary is paid directly to you, untouched by income tax.

The figure you see in your offer is what lands in your bank account, minus standard deductions for things like your pension contribution and health insurance. This makes a World Bank offer powerful. A $120,000 net salary is equivalent to a much higher gross salary in a regular job where you might lose 30% or more to taxes.

The net-of-tax salary is the cornerstone of World Bank compensation. It ensures that staff from over 170 member countries receive equitable pay by removing the complexity of varying national tax laws from the equation.

All the pieces of your compensation, base salary, benefits, and allowances, fit together to create your total package.

This flow shows how your base salary is the starting point, with benefits and allowances building out the full picture.

How the Tax Allowance Works for U.S. Staff

For U.S. staff, the process has one extra moving part but gets to the same place. You receive your net salary every month, just like everyone else. Then, on a quarterly basis, the Bank wires you the tax allowance to cover your estimated tax bill.

You’re still responsible for filing your own taxes with the IRS and your state. The Bank provides the funds to make you whole. The calculation for this allowance is complex; it’s based on a “tax-gross up” formula that assumes a standard set of deductions, making sure you have enough to cover the liability from your Bank income.

Remember this allowance is an estimate. Your personal tax situation, like outside income or unique deductions, can change your final tax bill. Still, the allowance is designed to be more than enough for the average person’s tax liability on their World Bank salary.

To make this crystal clear, let’s walk through a hypothetical calculation for a GF-level staff member.

Sample Net Salary Calculation (GF Level)

As you can see, the system works to ensure that after all is said and done, both employees have the same net purchasing power. The U.S. staff member just has the extra step of filing and paying their taxes using the allowance provided by the Bank.

How to Negotiate Your Salary Offer

Many candidates get this wrong. They see the formal grade structures and rigid salary bands and assume the offer is final. That’s a mistake.

While the salary band for your grade is fixed, your starting spot within that band is often flexible. This is where you can make a real difference. A good negotiation is about building a sharp, evidence-backed case for why you deserve to start at a higher step within your grade.

Know What’s Actually on the Table

First, be clear on what you can and can’t negotiate. You will not be able to change your grade level after the offer is on the table. The grade is tied to the job’s classification, not the candidate. The salary band for that grade is also set by Bank policy.

What is negotiable is your starting salary within that band. The Bank usually makes an initial offer between the minimum and the midpoint of the range. Your job is to justify a starting salary closer to that midpoint, or even higher if you bring something exceptional to the role.

Your negotiation isn’t about asking for more money. It’s about arming the HR officer with the justification they need to place you at a higher step. Make it easy for them to say “yes” by giving them a solid business case.

This distinction is everything. Frame your conversation around your specific value.

Building Your Case for a Higher Salary

A strong negotiation needs concrete evidence. Simply saying you have “a lot of experience” will fall flat. You need to draw a direct line from your specific skills and background to the job’s requirements.

Here are the key pillars for building your argument:

Exceptional Qualifications: Do you have specialized skills, hard-to-find language abilities, or technical certifications that are highly relevant? Quantify why these assets make you more valuable than a typical hire for that grade.

Competing Offers: This is your strongest leverage. A legitimate, higher offer from a comparable organization (like another MDB or a top private sector firm) provides a clear market benchmark. Be ready to discuss the details of that competing package.

Relevant Market Data: Research what similar roles pay at other international financial institutions or in the private sector. Showing that your skills command a higher salary on the open market provides powerful context.

Justifying Your Worth: Articulate exactly how your unique experience will let you deliver results faster. For example: “My ten years leading infrastructure projects in East Africa means I can bypass the typical learning curve and start delivering on the portfolio’s objectives from day one.”

Get these points sorted out before you get on the phone with HR. Write them down. Have specific examples ready. A well-prepared candidate is more convincing and shows you respect the process.

Common Questions About World Bank Pay

Even after you understand the grades and benefits, a few practical questions almost always pop up. It’s one thing to see the numbers on a chart, but it’s another to understand how they translate into your actual bank account.

Let’s clear up some of the most common sticking points.

How Does the Net-of-Tax Salary Really Work?

This is the most confusing and attractive part of the package. The “net-of-tax” salary is a core feature, but it works differently depending on your citizenship.

For most internationally recruited staff who are not U.S. citizens, the salary you see is what you get. The Bank pays you an amount that is already free from income tax. Your payslip will show that headline number, minus standard deductions for pension and health insurance. It’s that simple.

For U.S. citizens, it’s more complex because the U.S. government taxes citizens on worldwide income. To level the playing field, the World Bank provides a separate, quarterly tax allowance. This extra payment is calculated to cover your U.S. federal, state, and local income tax obligations on your Bank earnings. The goal is to make sure your final take-home pay is the same as a non-U.S. colleague at the exact same grade.

Are There Regular Pay Raises?

Yes, and they come in two flavors. Your salary grows over time to reflect market changes and your own contributions.

Every year, the Bank benchmarks its salary scales against a select group of public and private sector employers in the Washington, D.C. market.

This annual review usually leads to a structural adjustment across the entire salary scale. Think of this as a cost-of-living increase. On top of that, you’re also eligible for a merit-based increase tied directly to your annual performance review.

This dual system means your compensation grows annually, rewarding your hard work while protecting your purchasing power.

How Does Consultant Pay Differ from Staff Pay?

This is a crucial distinction. Being a consultant at the World Bank is completely different from being a staff member, especially when it comes to pay. Consultants, whether Short-Term (STCs) or Extended-Term (ETCs), are contractors.

Here’s what that means in practice:

No Benefits Package: Consultants do not get the Staff Retirement Plan, comprehensive health insurance, or paid leave.

You Handle Your Own Taxes: The daily or monthly rate you’re paid is a gross amount. You are entirely responsible for figuring out and paying your own taxes.

Fee-Based, Not Grade-Based: Your pay is a daily or monthly fee negotiated for a specific contract. It has no connection to the formal GA-GK staff grade structure.

A consultant’s daily rate can look attractive on paper, but it doesn’t come with the stability, long-term security, or extensive benefits that define a full-time staff salary package at the World Bank.

Ready to find your place at a leading global institution? At Multilateral Development Bank Jobs, we simplify your search by bringing you curated staff and consultant openings from over 30 MDBs every week. Start your journey here:

https://mdbjobs.com

.