World Bank Economist Salary Guide and Pay Comparison

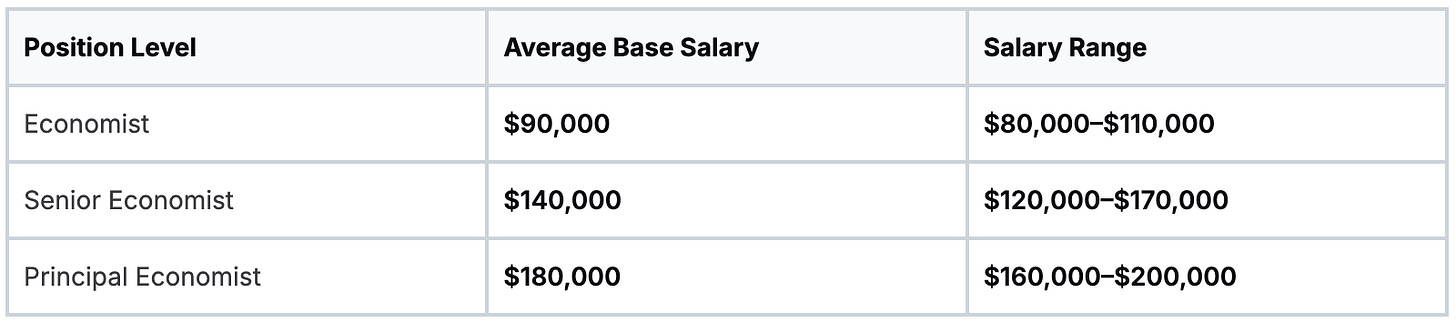

World Bank Economist Salary Bands

A World Bank economist earns between $90,000 and $200,000 depending on grade and experience. Entry-level economists start around $90k, mid-career pros average $140k, and senior roles exceed $170k. Each grade raises your pay bracket.

Understanding Salary Steps

Below is a table that breaks down average base pay and salary ranges for key economist levels.

Key Salary Stats For World Bank Economists

Description: This table summarizes average base salaries and range for key economist levels at the World Bank Group, reflecting mid-career and senior pay distributions.

It shows how pay increases with responsibility and tenure.

Several factors adjust these figures:

Grade Level sets your starting band based on role complexity

Contract Type affects your benefits and allowances

Duty Station triggers cost-of-living adjustments and location pay

Strong performance and niche skills push you to the top of each band.

Key Salary Drivers

Your take-home pay hinges on four main levers:

Experience Tenure: Each year in a relevant role raises your benchmark

Skill Niche: Specialized expertise, like sovereign debt analysis, commands a premium

Location Allowances: High-cost hubs like Washington, D.C., add extra pay

Market Surveys: Global compensation data influences annual adjustments

For a deep dive into benefits, location adjustments, and negotiation tactics, see our Complete Guide to the World Bank. Next up: total rewards and cost-of-living tweaks.

The latest survey shows an average of $164,235. It includes market adjustments and bonuses. Next, we’ll dig into benefits, allowances, and negotiation strategies.

Understanding World Bank Economist Salary Structure

Here’s how the Bank’s grading system ties to your pay. Each grade represents a level—higher tiers have bigger brackets.

Grade EC2 and EC3 are entry points, offering modest starts

Grades EC4–EC6 cover the mid-career stretch

Grades EC7+ represent senior and principal economist leadership

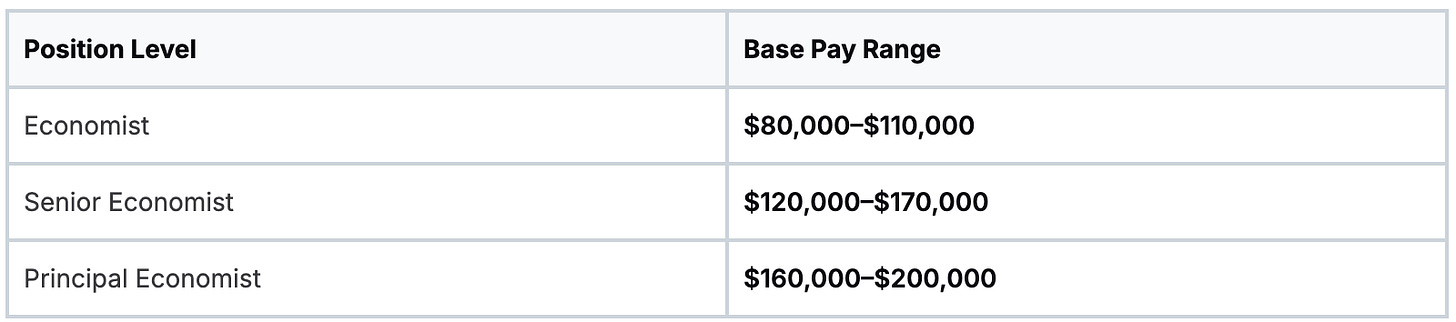

Base Pay Bands

The World Bank splits economist salaries into three bands. These ranges shift each year based on internal data and market benchmarks.

Imagine an EC3 economist who starts at $85,000 after two years in policy research. By year five, thanks to stellar performance, they can reach $105,000.

Years on Grade adds about 3% annually

Peer Benchmarks determine your position within the bracket

Skill Premiums reward expertise like climate finance or macro modeling

How Experience And Skills Shift Your Bracket

Solid results push you toward the top of your band. Add five extra years in relevant roles and you move from the lower third of a bracket into its middle.

Specialized abilities like advanced econometric techniques or development finance know-how often translate into a pay premium.

“Tracking internal reviews and external market data is your best bet for staying in stride with top earners.”

High performance ratings carry weight. Exceed expectations and you land near the upper end. Leading projects or taking on niche tasks can push you even further.

How Surveys Shape Increases

Every year external salary surveys feed into the Bank’s compensation reviews. For 2024–2025, industry figures show:

PayScale reports an average base salary for a Senior Economist of $164,235

Indeed shows economists earning $138,630 on average, with lows of $63,000 and highs over $242,000

This data shows mid-career roles cluster in the low-to-mid six figures, with senior technical grades between $150k and $200k. Read the full research on PayScale.

Inside the Bank, a compensation committee meets twice a year to weigh inflation, local markets, and Board-set guidelines to fine-tune base bands.

Tracking Your Progression

Follow these steps to chart your pay trajectory:

Identify Your Grade

Compare Market Data

Log Achievements

Prepare For Review

This method brings clarity to your earning potential. Detailed logs of milestones and publications become powerful evidence during salary reviews. You’ll know exactly what drives your pay and how to negotiate smarter come promotion season.

Impact Of Benefits And Allowances

The base salary is just the starting point. Add benefits and allowances such as housing support, health coverage, and hardship stipends to see the full package.

Picture your total compensation as a pie chart. The base salary holds one slice, but extras can swell your earnings by 20–40%.

The Bank updates its scales annually to match market trends and living costs. Your base pay is only half the story. Allowances, employer-paid insurance, and pension contributions boost your actual take-home. Get details on World Bank Group HQ and Country-Office Compensation Scales.

Housing Allowance: Offsets local rent with a flat rate or percentage of your base salary

Health Coverage: Medical, dental, and vision plans underwritten by the Bank

Hardship Stipend: Cash for duty stations with challenging conditions

Pension Contributions: Employer matches your retirement savings up to a cap

Life Insurance: Coverage equal to one times your net salary for long-term staff

Fixed-term and extended-term staff get different support levels, while permanent appointments enjoy the full suite.

Location also matters. A posting in London or Washington, DC might offer modest housing support, while an office in an emerging market could include hardship pay worth 15–25% of your base. That can make a public-sector package competitive with private banks.

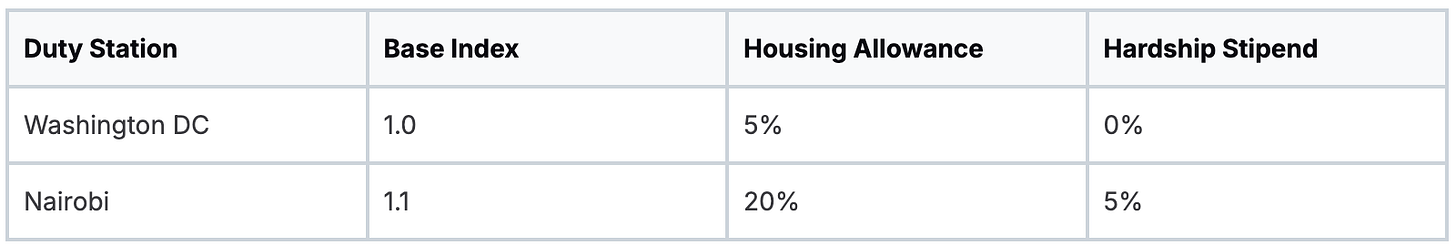

Comparing Duty Station Packages

In locations with a hardship index above 1.2, top-ups often beat private-sector roles. For example, an economist in Nairobi might get 25% in housing and hardship allowances, while HQ staff in Washington, DC only get cost-of-living adjustments.

To illustrate, a Senior Economist with a $150,000 base plus 20% in allowances at an emerging market station nets $180,000 in total compensation.

“Non-cash benefits add tens of percentage points to your take-home value.”

Always compare total rewards, not just base pay, to see the true value.

Read also: Why do MDB employees pay no taxes to see how tax treatment on allowances shapes your net income.

How To Weigh Benefits

List every benefit and allowance tied to your role

Assign a monetary value before and after tax using published scales

Plug those numbers into a simple spreadsheet

Compare the sum against cash-only private-sector offers

Focus on high-impact perks like housing and health contributions. This approach gives you a clear picture of total rewards and equips you to negotiate with confidence.

Location Adjustments And Cost Of Living

Where you work shifts your World Bank economist salary by a surprising amount. The Bank applies a geographic adjustment factor for local living costs and hardship levels.

Headquarters roles follow one scale, while country offices align pay with local markets. For instance, Washington, DC has a different index than Nairobi or New Delhi.

How Location Shapes Salary

Every duty station has its own cost-of-living index, benchmarked against a reference point. An index of 1.2 means you’re paying 20% more than baseline.

Allowances for housing and hardship add on top. In Tokyo, you might get a 15% housing supplement; in Kabul, a 20% hardship stipend.

Key Components Of Adjustment

Cost-of-Living Index: Tracks local price levels

Housing Allowance: Helps cover rent based on your base

Hardship Stipend: Extra pay for tough duty stations

Education Grant: Reimburses dependent schooling costs

Currency Adjustments: Shields you from exchange-rate swings

Together, these pieces can boost your total compensation by 20–30% over base pay.

Estimating Your Net Package

Start with your base salary and apply the station index. Then add housing and hardship allowances before taxes.

A Senior Economist earning $150,000 in Washington, DC nets about $157,500 after housing. The same role in Nairobi jumps to $180,000 with higher indices and allowances.

“A smart forecast includes every supplement and index before you compare postings.”

This calculation shows where the real value lies. Armed with those numbers, you can weigh postings effectively. Exchange rates and local tax rules can sway your take-home pay. Plug those variables in early to keep projections grounded.

Tips For Accurate Estimates

It pays to work from the latest index data before you run any models.

Review official cost-of-living indices on the World Bank HR site

Use currency hedging tools when rates fluctuate

Document all assumptions and allowance calculations in a spreadsheet

Crunching real data gives you leverage in negotiations. You’ll speak total compensation, not just base salary.

Comparing Pay With Private Sector And MDBs

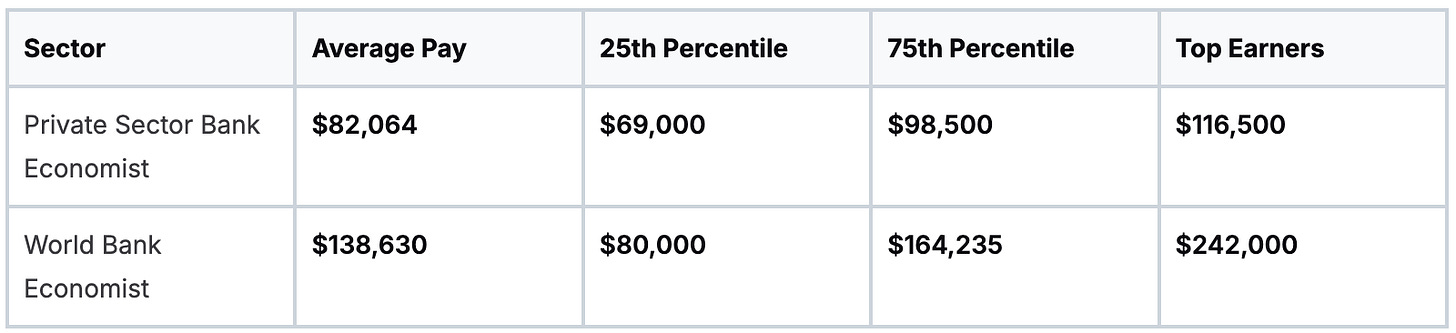

Line up World Bank economist salaries alongside private banks and other MDBs. External data shows US private-sector bank economists earn an average of $82,064 per year, with most between $69,000 and $98,500. Top performers hit $116,500. A World Bank Economist pulls in $138,630, while a Senior Economist averages $164,235. Learn more on ziprecruiter.

Comparison Of Economist Pay By Sector

World Bank pay sits well above private-sector midpoints. The upper quartile alone underscores a substantial wedge in total compensation.

Breaking Down Benefits And Allowances

Factor in benefits and the story gets richer. Health coverage, life insurance, education grants, and allowances can add 20–30% to your base. Pension contributions at MDBs typically equal about 15% of salary, and many allowances are tax-free.

“A comprehensive comparison must include benefits and pension to see the full value.”

Insights On MDB Compensation

Other MDBs—like IMF and ADB—offer similar salary bands but vary on allowances and tax treatment. Compare these packages in our analysis of multilateral bank careers in World Bank vs IMF vs ADB career showdown. This side-by-side view shows financial trade-offs and lifestyle factors.

Key Factors Driving Pay Differences

Base Pay Bands: Private banks and MDBs start at different points

Benefits Packages: Total value can jump by 30% with the right allowances

Pension Value: Adds about 15% or more to long-term rewards

Tax Treatment: Many MDB perks are tax-free, boosting net take-home

Negotiation Tips For Pay Packages

Base salaries may feel fixed, but there’s room to maneuver:

Benchmark against external salary surveys to secure higher offers

Highlight niche skills—think advanced econometric modeling or policy management

Discuss hardship indices and housing supplements for tough postings

Use cost-of-living data to argue for better allowances

A private-sector economist might negotiate a 5% bump after sharing survey insights. At the World Bank, candidates often add 10% to their housing support through allowance indices.

Final Takeaways

Always compare base pay, total rewards, and location factors together.

“Comparisons grounded in data give you the edge during negotiations”

Compare total packages—not just the headline salary

Factor in tax exemptions and pension perks for true net value

Keep your numbers fresh by updating pay comparisons each year.

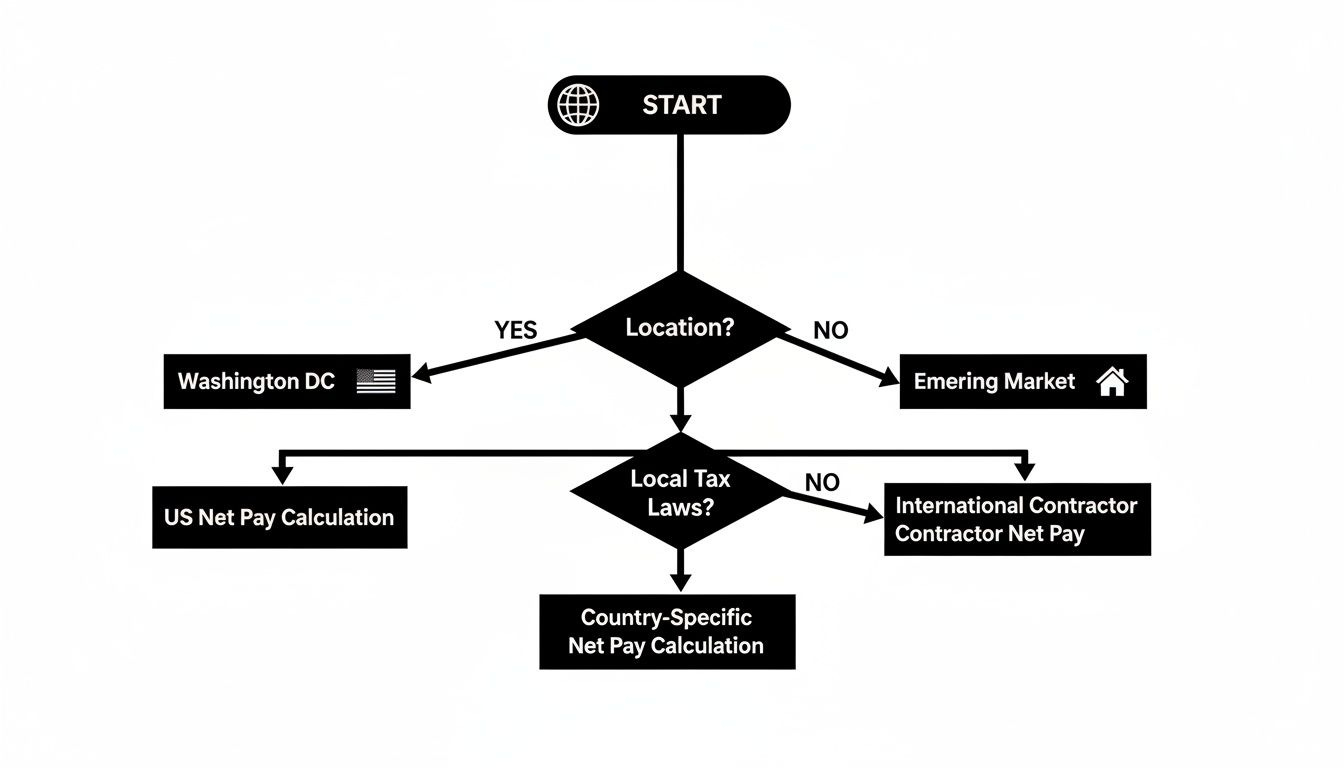

Example Net Pay Calculations And Methodology

Here are two net-pay scenarios for a World Bank economist at different duty stations. We’ll spell out assumptions—tax rates, social security deductions, pension levies—so you can plug in your numbers. This gives you a roadmap: pick a location, choose your grade, and follow each step.

Net Pay Calculation For Washington DC

Start with your gross base salary. A Senior Economist at grade EC5 earns $150,000 a year.

Next, apply deductions:

Federal and state taxes at 30%: $45,000

Social Security & Medicare at 7.65%: $11,475

World Bank pension levy at 10%: $15,000

After these, you land at about $71,025 in net pay for Washington DC.

Net Pay Calculation For Emerging Market Office

Use the same $150,000 base:

Local income tax at 20%: $30,000

Social security at 6%: $9,000

Bank pension levy at 10%: $15,000

Housing allowance at 20% (tax-exempt): $30,000

Your net pay jumps to around $116,000—a 30% increase over the DC scenario, thanks to the housing allowance.

Customize Your Own Pay Model

Build a flexible spreadsheet:

Enter your gross base salary and grade

Fill in local tax brackets and social security rates

Add pension and health deductions per World Bank scales

Apply housing and cost-of-living allowances for your duty station

Swap out rates and allowances to test different postings. Visualize results side by side to find the highest take-home pay.

“Accurate assumptions and transparent steps turn a black box into a powerful negotiation tool.”

With this methodology, you can forecast take-home pay, compare postings, and strengthen your bargaining position. Next up: negotiation strategies to ensure you get the package you deserve.

Negotiation Strategies For Economists

Negotiation can be the difference between a good offer and a great one. When you’re armed with data and a clear plan, you steer the conversation.

Use these tactics to boost both cash and non-cash rewards:

Anchor your ask with external salary surveys

Package allowances for maximum value

Highlight niche skills and performance

Leverage regional cost-of-living data

Benchmark Your Market Data

Strong negotiation starts with hard numbers. Gather figures from sources like PayScale and Indeed, then set your anchor figure.

Presenting a specific target gives you leverage.

“Candidates who share market data boost their offers by 5–10%.”

Package Benefits For Maximum Value

Don’t fixate on base salary. Perks can add tens of thousands to your bottom line. Think housing allowance, education grants, and hardship pay as negotiation levers.

Frame these as part of your total rewards. If a salary bump is off the table, ask for a 15% housing support increase instead.

Component Typical Request Impact on Net Pay Base Salary +10% +$14,000 Housing Allowance +15% +$20,000 Education Grant +5% +$7,000

Leverage Regional Demand

Your duty station choice is a bargaining chip. High-cost or hard-to-staff locations come with extra allowances.

Point out economist shortages in an emerging market to strengthen your case. Aim for the window between verbal offer and contract signing:

Confirm role requirements

Lead with your data-backed ask

Emphasize unique contributions

Negotiate benefits alongside salary

“Preparation wins more raises than bravado ever will.”

Timing Is Critical

Bringing up numbers too early can derail talks. Wait until you have a clear offer, then praise the role’s impact before shifting to compensation.

Begin after verbal agreement on responsibilities

Use a call or video meeting for details

Document next steps and timelines in writing

“Approaching compensation as collaboration creates win-win results.”

Stay proactive and follow industry trends to negotiate adjustments ahead of annual reviews.

Ready to take your career further? Sign up for insider job alerts and negotiation insights with Multilateral Development Bank Jobs at

https://mdbjobs.com

.

Well done and a much needed post. Sometimes it feels like that Critical Journalism which is integral to the maintenance of Natural Justice and our coequal American Republic, has gone missing somewhere or something!

Our latest (attempting to connect our two halves of one world)

https://open.substack.com/pub/republia/p/for-the-preservation-of-freedom-and?r=4ucf6d&utm_medium=ios&shareImageVariant=overlay