World Bank Grades and Salaries: A Practical Guide

Trying to figure out World Bank salaries can feel like decoding a secret language. Once you get it, the system is logical. It all comes down to a grade structure that dictates your pay, title, and career path.

How World Bank Pay Actually Works

Forget the rumors. The World Bank compensation system is built on one thing: grades. These grades, running from GA to GL for professional staff, are the foundation for everything. Each grade has a specific salary band that determines your earning potential.

This isn’t an arbitrary system. The Bank reviews these salary bands every year, benchmarking them against other international organizations and the private sector to stay competitive and attract top talent.

The Core Principles of Compensation

The pay philosophy rests on two ideas: offering market-competitive salaries and rewarding performance.

Every job at the Bank is slotted into a grade. Your starting salary is a specific point within that grade’s salary range, determined by your experience and qualifications. If you’re curious about real-world numbers, sites like levels.fyi offer useful crowdsourced data.

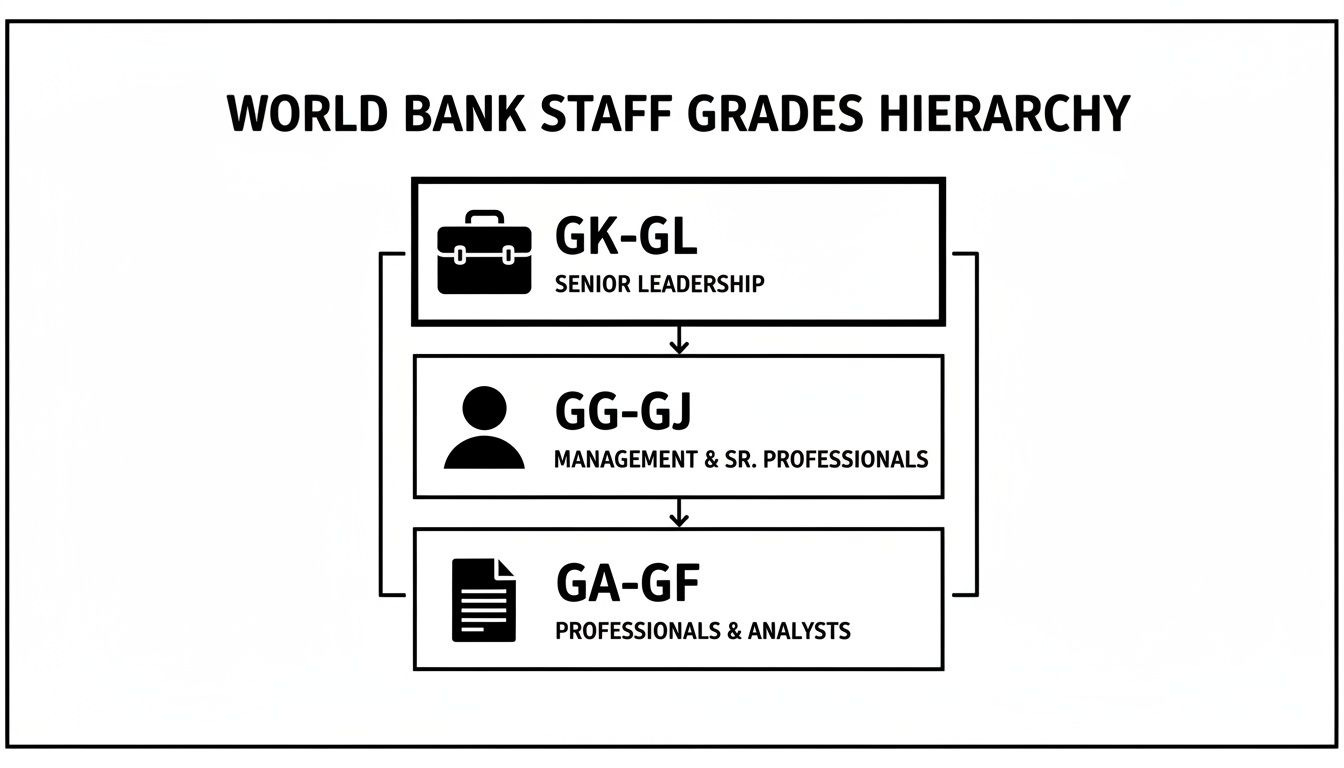

This hierarchy gives you a clear career roadmap.

As the diagram shows, the grades are clustered into clear career levels, from entry-level professionals to the senior leaders who set the Bank’s direction.

Finding Your Place in the System

What do these grades mean in practice? It comes down to the scope and complexity of your job.

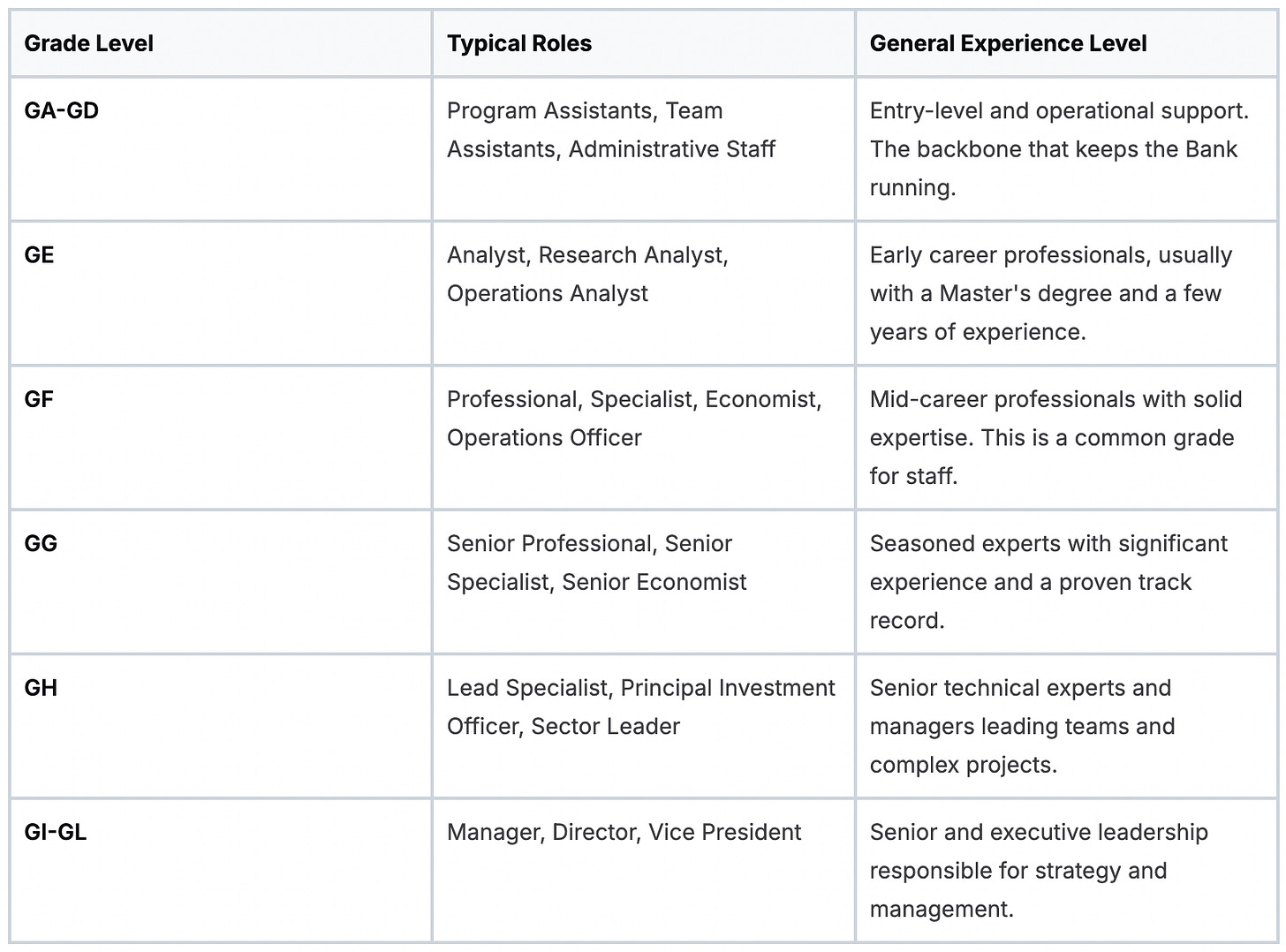

We’ve broken down the main professional grade bands and the kinds of roles you’ll find in each. This should help you map your background to the Bank’s structure.

World Bank Professional Staff Grade Levels At A Glance

Think of these grades as rungs on a ladder. Career progression means climbing to a higher grade, which unlocks a new, higher salary band. You also get salary increases within your current grade based on strong annual performance reviews.

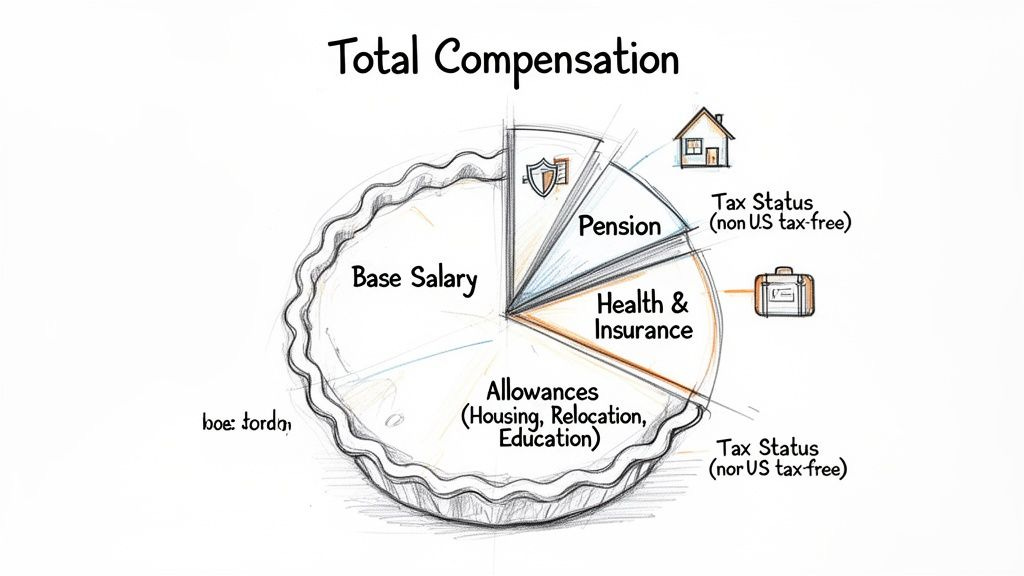

Remember, your base salary is only one part of the equation. The total compensation package, including benefits, allowances, and the tax-free status for many staff, is where the real value is.

Getting a handle on this grade structure is the first step. To understand the context, you need to know more about the institution itself. Check out our deep dive into how the World Bank actually works. It provides the foundational knowledge you need to navigate your career at the Bank.

A Realistic Look at World Bank Salary Bands

Let’s get to the numbers. World Bank salaries revolve around the Washington D.C. headquarters. The pay scales there are the highest and set the benchmark for the entire institution.

Mid-level professional roles, typically at the GF grade, almost always command a six-figure salary. As you climb to senior technical expert positions at the GG or GH level, the compensation jumps significantly. These roles demand deep expertise and leadership, and the pay reflects that.

Why Online Averages Are Misleading

You’ve probably seen “average” World Bank salary figures online. Be careful with those. They’re often deceptive.

An “average” figure lumps together a massive range of roles, from an entry-level analyst in a small country office to a Senior Director at HQ. This mashes everything into a single number that isn’t useful. The key is understanding the massive difference between a role in D.C. and its equivalent in a field office. A headquarters position has a much higher base salary than the same grade in a lower-cost country. Don’t let a generic number throw you off.

For a more grounded view, look at crowdsourced data. For instance, PayScale data once showed an average base salary for World Bank Group employees around $112,293, with reported bonuses near $15,000. That gives you a more realistic total cash figure, and you can find more detailed breakdowns in their full reports.

Headquarters Salary Benchmarks

To give you a concrete idea, let’s look at realistic net salary ranges for professional grades at the Washington D.C. headquarters. These are solid estimates based on public info and insider knowledge, representing the base pay you can expect.

Remember, these are net salaries. They’re tax-free for most non-U.S. staff. This is a huge advantage that makes a World Bank offer much more powerful than a private sector role with a similar gross salary.

GE (Analyst Level): You’re likely looking at a starting net salary in the $90,000 to $115,000 range. This is the launchpad for early-career professionals.

GF (Mid-Career Professional): This is the workhorse grade and the most common one. Expect a net salary band from approximately $115,000 to $165,000. Where you land in that range depends on your years of relevant experience.

GG (Senior Professional): For seasoned experts, the net salary range typically falls between $160,000 and $230,000. These roles demand substantial experience and proven technical skill.

GH (Lead Specialist/Manager): At this senior level, you’re looking at net salaries starting around $220,000 and climbing up to $280,000 or more. These individuals are leaders in their fields.

These numbers are just the core of your compensation. Your total package includes a top-tier pension plan, excellent health insurance, and, for expats, significant allowances that aren’t reflected in these base figures.

Knowing these bands is the first step in figuring out what a potential offer is worth. If you’re targeting an economist role, knowing the typical salary for a GF or GG grade gives you a powerful baseline for any conversation.

If you want to dig deeper into specific roles, check out our guide on the World Bank economist salary structure. It gives a focused look at one of the Bank’s most iconic career paths. Next, we’ll break down how benefits and your duty station dramatically change your actual take-home pay.

Decoding Your Total Compensation Package

Focusing only on the base salary in a World Bank offer is a classic mistake. The net pay is just the starting point. The real financial power comes from the benefits package that significantly increases your total compensation.

To know what you’re being offered, you have to look at the entire picture.

This package is built to attract a global workforce, providing a level of security that few private sector jobs can match. Let’s break down the key components.

The Tax Situation Explained

One of the biggest perks is the tax status of your income. For most non-U.S. staff working at the Washington D.C. headquarters, your salary is net of income tax.

This means you get the full amount without deductions for U.S. federal or state income taxes, a benefit from international agreements. It’s a huge deal.

U.S. citizens are taxed on their worldwide income. To level the playing field, the World Bank provides an additional tax allowance to American staff. This payment is calculated to offset their estimated U.S. income tax bill, ensuring employees at the same grade have comparable take-home pay, regardless of nationality.

Core Financial and Health Benefits

The Bank offers a robust suite of benefits that provide financial security. These are the pillars of the total compensation package.

Pension Plan: The World Bank’s retirement plan is exceptionally generous. Both you and the Bank contribute, and it grows into a significant asset. It’s a defined benefit plan, which is incredibly rare, and provides a reliable income stream when you retire.

Health, Life, and Disability Insurance: The Bank provides comprehensive medical and dental plans that cover you and your eligible dependents anywhere in the world. You also get solid life and disability insurance. These plans are heavily subsidized, so your out-of-pocket costs are far lower than for similar private coverage.

These benefits form a financial foundation that lets you focus on your work.

The real value of a World Bank offer lies in its totality. When you add the pension contributions, subsidized insurance, and potential allowances to your net salary, the true compensation figure is often 30-40% higher than the base pay number.

Allowances for Expatriate Staff

For internationally recruited staff moving to a new duty station, the World Bank provides allowances to ease the financial and logistical challenges of relocation. These benefits are a game-changer for expats and their families.

Relocation Grant: This is a lump-sum payment to help cover the immediate costs of moving and setting up a new home.

Housing Benefit: Depending on the duty station, expat staff may be eligible for a housing subsidy. This is valuable in high-cost cities.

Education Subsidy: For staff with kids, this is one of the most valuable benefits. The Bank provides a grant covering a significant portion of tuition at eligible private schools. The Bank is a major global financier of education, investing $26 billion across 94 countries, and this commitment is reflected in how it supports its own staff.

When you add these pieces together, you see that a World Bank offer is a carefully constructed package designed for a global career, providing stability and serious support.

How Location Impacts Your Take-Home Pay

Where you work is as important as what you do when it comes to your World Bank salary. Your duty station is a huge driver of your final pay.

The system is built around a single benchmark: the Washington D.C. headquarters. The salary scales there are the highest, reflecting the cost of living and the need to attract global talent. The Bank doesn’t just use the D.C. salary for a role in a lower-cost country.

Instead, it uses a locality adjustment. This aligns your pay with local market conditions and the cost of living in your city.

This is why a GF-grade position in a city with a lower cost of living has a different base salary than the same GF grade in a high-cost hub like Geneva. The goal is to provide a comparable standard of living for staff, no matter where they are.

The Two Types of Staff: International vs. Local

The World Bank sorts staff into two main buckets. This distinction has a huge impact on your compensation package.

Internationally-Recruited Staff (IRS): These are expats hired from the global talent pool to work outside their home country. Their pay package is designed to make this international move possible, which is where allowances for housing, education, and relocation come in.

Locally-Recruited Staff (LRS): These professionals are hired to work in their home country or region. Their salaries are benchmarked against the top end of the local labor market to keep the Bank competitive as an employer. They don’t get expat benefits because they aren’t relocating internationally.

This two-track system lets the Bank maintain a global standard for its experts while competing for top local talent everywhere it operates.

A Tale of Two Paychecks: HQ vs. Country Office

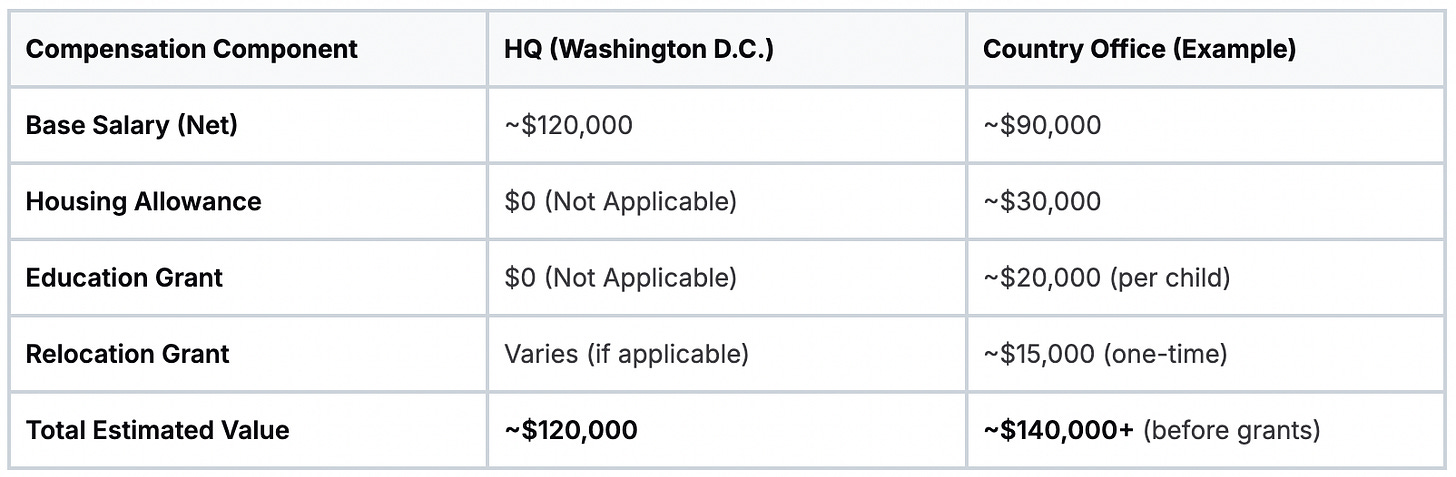

Let’s make this concrete. Imagine two people hired at the GF grade. One is based at HQ in Washington D.C., and the other is an internationally-recruited staff member in a country office in a lower-cost region.

Their pay structures will look completely different. The following table gives a hypothetical breakdown.

Illustrative Pay Differences: HQ vs Country Office

The HQ staffer gets the high D.C. benchmark salary. The expat in the country office gets a lower base salary, adjusted for the local cost of living. But their total compensation can be similar or even higher once you factor in the valuable expat benefits like housing allowances and education grants.

This difference underscores the Bank’s unique position as an international employer.

The World Bank operates in a global context, and its pay reflects that. Professional pay bands, often placing staff well above $80,000–$150,000 annually, contrast sharply with the median national incomes in many client countries, which can be under $5,000.

This gap shows that the Bank competes in a global talent market, not a local one. It’s a reality fundamental to how the institution functions.

Finally, remember that for many internationally-recruited staff, the net salary is only one part of the picture. The tax-free status most non-U.S. staff enjoy is a massive financial advantage. You can learn more in our detailed guide explaining why MDB employees pay no taxes. Understanding this principle is key to evaluating the true value of any offer.

How To Navigate Job Postings and Salary Negotiation

Understanding the theory behind World Bank grades is one thing. Using that knowledge to land the offer you want is another. This is where we turn theory into action.

Every World Bank job posting is a map. Buried in the vacancy announcement is the most crucial clue for your salary expectations: the grade level. You’ll usually see it listed explicitly, something like “Grade: GF“ or “Term Duration: 3 years 0 months [GF]“. Finding this is your first mission.

Once you have the grade, you know the ballpark. A GF role has a specific pay range, a GG role has a higher one, and so on. This instantly tells you if the position lines up with your financial goals.

The Art of Salary Negotiation

“Negotiating” at the World Bank isn’t like haggling. You can’t just toss out a big number. The process is structured, data-driven, and runs on a specific formula. But that doesn’t mean you’re powerless.

Your starting salary is calculated based on two factors: the job’s grade and your relevant years of experience against the job’s minimum requirements. Your goal is to prove, with hard evidence, that your experience and past earnings justify a spot at the higher end of that grade’s salary band.

The Bank’s offer is a calculation, not an opinion. Your job is to provide the best inputs for that calculation by meticulously documenting your professional history and previous earnings.

To do this, you need to come prepared. The hiring team will require detailed proof of your previous salaries. This isn’t a casual ask; it’s a fundamental part of their formula.

Building Your Case for a Better Offer

You must be ready to provide clear, verifiable documents for your past compensation. This is non-negotiable.

Official Payslips: Start gathering payslips from your current and former employers. These are the gold standard.

Employment Contracts: Past contracts clearly state your base salary and other fixed compensation.

Tax Documents: Official tax filings are another rock-solid way to prove your annual income.

Bonus and Commission Statements: If a big chunk of your pay was variable, you need official statements detailing these amounts.

The more organized your documentation is, the stronger your case. You’re building a file that proves your market value. When you present this, frame your experience using the World Bank’s language. Point to specific projects and accomplishments that directly match the “Selection Criteria” section of the job post.

This isn’t about being aggressive. It’s about being prepared, professional, and precise. You are providing the data for the Bank to justify placing you at a favorable point within the established salary band. Do your homework and you put yourself in the driver’s seat.

Got Questions About World Bank Pay? We’ve Got Answers.

Even after you get the hang of the grade system, a few questions always pop up. Let’s dive into the most common ones with straight, no-nonsense answers.

How Does The World Bank Adjust Salaries For Inflation?

The World Bank doesn’t set pay scales and forget them. Every year, a formal process ensures salaries stay competitive and your buying power isn’t eroded by inflation.

The Bank does a full analysis, benchmarking its pay bands against a group of employers from the public and private sectors in key labor markets. They want to see how the market has shifted.

Based on that data, which covers inflation and salary trends, the Bank’s leadership proposes a structural adjustment to the pay scale. Once the Board of Executive Directors approves it, the new scale is rolled out. This is how World Bank grades and salaries hold their value year after year.

What’s The Deal With Net vs. Gross Salary?

This is a critical part of the compensation package. The answer depends on who you are.

For most staff who are not U.S. citizens working at the Washington D.C. headquarters, their salary is quoted as “net of tax.” This means the number on your offer letter is what you take home; no income tax is taken out. This is a powerful perk of the Bank’s status as an international organization.

U.S. citizens have to pay U.S. income taxes on their earnings. To make things fair, the World Bank gives its American staff an extra payment called a “tax allowance.” This amount is calculated to cover their estimated U.S. tax bill. The point is to level the playing field so two people at the same grade have similar take-home pay, regardless of nationality.

It’s critical to clarify whether a salary figure is net or gross. A $120,000 net salary for a non-U.S. national is financially equivalent to a much higher gross salary in the private sector once you account for taxes.

When you’re looking at numbers, always confirm if you’re talking net or gross. It makes a massive difference.

Are World Bank Salaries Negotiable?

Yes, but not in the way you’re used to. Forget the typical back-and-forth where you ask for a higher number. The process at the Bank is highly structured.

You negotiate your placement within the pre-set salary band for that grade.

The Bank calculates your starting salary based on your documented experience against the minimum requirements for the role. Your goal is to provide evidence showing that your background, skills, and past earnings justify starting you at the higher end of that grade’s range.

This means you need to be meticulous. Gather your past pay stubs, bonus statements, and any documentation of your qualifications. The stronger your evidence, the better your case for a higher starting point within the band. You aren’t changing the range; you’re proving you deserve to be at the top of it.

How Do Consultant Salaries Compare To Staff Salaries?

Comparing a consultant’s daily rate to a full-time staff salary is like comparing apples and oranges. They’re completely different employment models.

Consultants, or Short-Term Consultants (STCs), get paid a daily rate. At first glance, that rate can look impressive. But it’s an all-in figure.

Here’s what that daily rate has to cover out of your own pocket:

Taxes: As a consultant, you handle all your income and self-employment taxes.

Health Insurance: There’s no subsidized health plan. You find and pay for your own coverage.

Retirement: The Bank doesn’t contribute to a pension for you. Funding your retirement is 100% your responsibility.

Paid Leave: Forget paid vacation, holidays, or sick days. If you don’t work, you don’t get paid.

Once you factor in the value of a staff member’s benefits package—the generous pension, world-class health insurance, paid leave, and potential expat allowances—the total compensation for a staff role is almost always significantly higher.

A consulting gig offers flexibility and is a great way to get your foot in the door. But for long-term financial security, a full-time staff appointment is in a different league.

Finding the right role at a multilateral development bank means staying on top of the latest opportunities. At Multilateral Development Bank Jobs, we curate and send you the latest full-time staff and consultant listings from over 30 MDBs and international organizations directly to your inbox every week. Sign up for free today to get the edge in your job search.