How to Find and Win IMF Job Vacancies

Landing a job at the International Monetary Fund is tough. These roles are intensely competitive, drawing the sharpest minds in global economics and finance. A great resume is just the entry ticket. To get noticed, you need an insider’s understanding of what the IMF does, how it hires, and the high-stakes world it operates in.

Understanding the IMF Hiring Landscape

Before you touch your CV, you have to understand how the IMF builds its teams. This isn’t a typical corporate hiring machine. The Fund operates at the center of the global economy, tackling massive issues like financial stability, government fiscal policy, and monetary cooperation among its 190 member countries.

That mission dictates every hire. The IMF looks for people with serious quantitative skills, a sophisticated grasp of macroeconomics, and the ability to perform in a multicultural, high-pressure environment. A degree from a top university helps, but your proven analytical firepower gets you through the door.

Let’s break down the main ways people join the IMF.

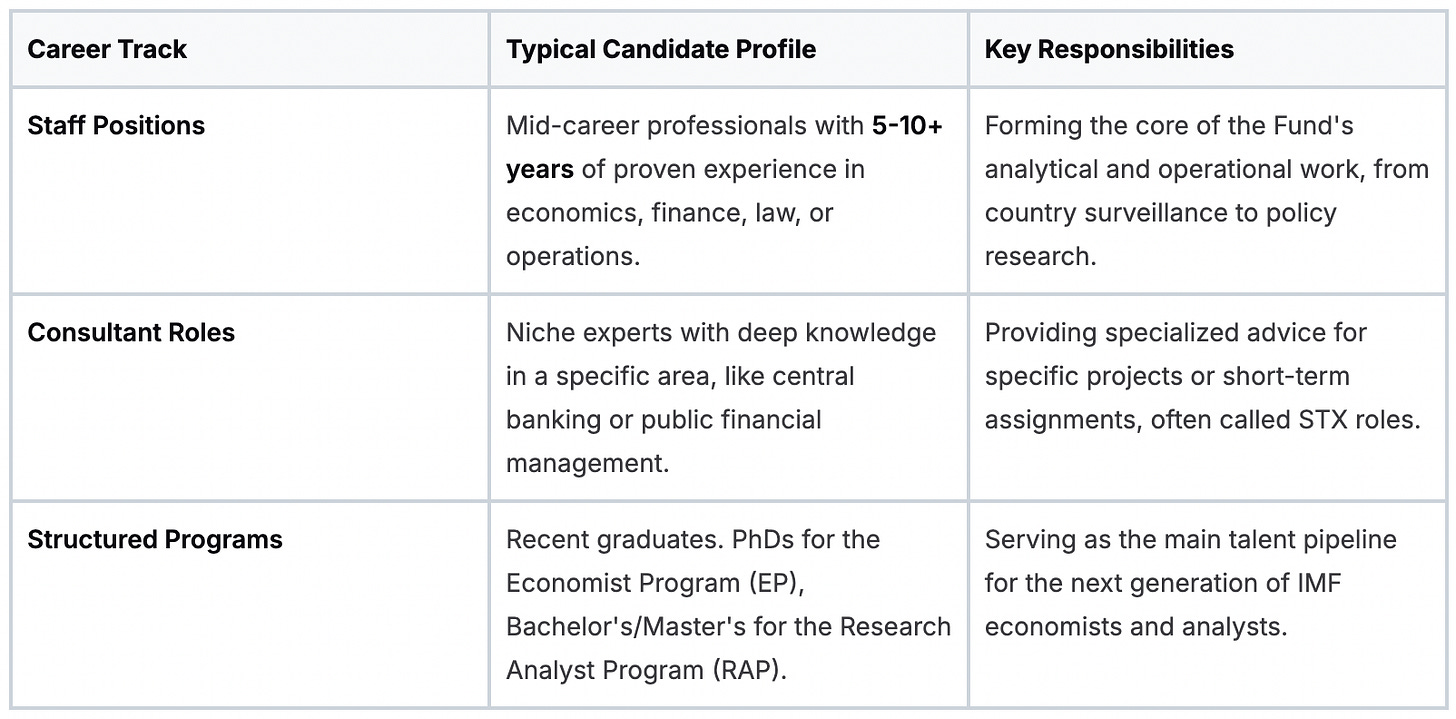

Key IMF Career Tracks at a Glance

Here’s a summary of the primary entry points for anyone looking for job vacancies at the IMF. Knowing where you fit is the first step in building a winning application.

Each track demands a completely different strategy. Applying without knowing the difference is like sailing without a map. You won’t get far.

Navigating these paths successfully takes a smart plan. For more detailed advice on positioning yourself for roles at institutions like the IMF, check out Your Practical Guide to Landing Jobs.

What the IMF Truly Values in Candidates

Look past the job description, and you’ll find the IMF wants a specific professional DNA. They value intellectual rigor and the ability to produce top-tier analysis under intense deadlines. This isn’t an academic ivory tower. Your work directly informs policy decisions that affect entire economies.

The IMF’s core mission is to foster global monetary cooperation and secure financial stability. Every role, from research analyst to department director, supports this objective. Your application must show how your skills directly contribute to this high-stakes work.

A global mindset is non-negotiable. Experience working across cultures and a real understanding of diverse economic landscapes are essential. Your ability to collaborate with colleagues from all corners of the world is as critical as your technical skills. The Fund’s work is global, and its workforce reflects that.

The Big IMF Recruitment Programs: Breaking It Down

The IMF hires seasoned professionals for specific jobs, but its most visible openings are in its structured recruitment programs. For anyone early in their career, these are the main doors into the Fund. Getting in is tough, but knowing how the programs work gives you a huge advantage.

These are hyper-competitive, multi-year tracks designed to build the next generation of IMF economists. Think of it less like a job application and more like an entrance exam for a long-term career at the center of the global economy. To have a shot, you need a specific mix of top-tier academics and hard, real-world skills.

The Research Analyst Program (RAP)

The Research Analyst Program (RAP) is the IMF’s primary funnel for talent with a Bachelor’s or Master’s degree. The “research” title is a bit misleading. This is a hands-on, analytical role where you provide direct support to the Fund’s senior economists.

Your days are filled with data analysis, running econometric models, and preparing materials for high-stakes mission travel and reports. It’s demanding, quantitative work. You’ll wrestle with massive datasets, run statistical models, and contribute directly to the IMF’s core work of economic surveillance and lending.

A standard RAP contract is for a two-year term, with a possible extension. It’s your chance to prove you have what it takes on a global stage and build a foundation for a career in international finance or policy. Many RAP alumni go on to top PhD programs or land roles at other major international organizations.

The RAP boils down to one question: can you execute? Can you take a complex economic question, find the right data, apply the right analytical tools, and present your findings clearly? That’s the test.

To get in, your application must showcase quantitative skill. The RAP team actively seeks candidates with strong quant skills for these fixed-term roles in Washington D.C. These jobs, posted at grades A06, A07, and A08, demand fluency in tools like MS Excel, STATA, R, and EViews.

You’ll need a Bachelor’s (a Master’s is preferred) in Economics, Finance, or a related field, plus about two years of relevant experience. You can find more detail on exactly what the IMF looks for in RAP candidates.

The Economist Program (EP)

The Economist Program (EP) is the most prestigious path to becoming a career economist at the Fund. It’s exclusively for recent or soon-to-be PhD graduates in economics and related fields. Let’s be clear: a PhD is a non-negotiable requirement.

The EP is a three-year program that immerses you in the IMF’s work. You’ll rotate through two different assignments in various departments, getting firsthand experience in everything from country surveillance to policy analysis and research. This rotation is designed to forge well-rounded economists who understand the IMF’s full mission.

Competition for EP spots is fierce. The selection process is a gauntlet of multiple interview rounds, a writing test, and a formal presentation of your job market paper. Recruiters are looking for more than a stellar academic record. They want to see your potential to translate dense economic theory into practical, actionable policy advice for member countries.

Successful EP candidates share a few key traits:

Deep Macroeconomic Knowledge: You must have a sophisticated grasp of international economics, monetary policy, and fiscal issues. This is the baseline.

Advanced Econometric Skills: Your ability to build, interpret, and defend complex models is assumed. You will be grilled on your methodology.

Clear Communication: The IMF needs economists who can explain their findings to finance ministers, not just other academics.

Graduating from the EP almost always leads to a permanent staff position as an economist. It is the gold standard for starting a long-term career at the IMF and puts you on a path to influence global economic policy.

Finding Opportunities Beyond the Flagship Programs

The big programs like RAP and EP get all the attention, but they aren’t the only way into the IMF. Focusing only on them is a rookie mistake.

The Fund constantly seeks seasoned specialists for critical roles and short-term experts for specific, urgent problems. This is where your hard-won experience really counts.

These opportunities are for professionals who have already built a career and bring deep, practical knowledge. We’re talking about mid-career economists, financial sector supervisors, communications officers, and lawyers who can contribute from day one. These roles are about deploying your expertise, not being molded.

The IMF hires for its immediate needs. It might need a public financial management expert for a capacity development mission in Southeast Asia or a central banking specialist to advise on a new monetary policy framework. These are not generalist roles; they demand proven skills in a particular domain.

Experienced Professional and Lateral Hires

The IMF maintains a steady pipeline of jobs for experienced professionals. These are permanent staff positions, similar to senior-level hiring at any major global institution. The key difference is the hyper-specific nature of the required skills.

These roles appear to fill gaps in specific departments. For instance, the Fiscal Affairs Department might need someone with ten years of experience in tax policy reform, while the Monetary and Capital Markets Department could be hunting for an expert in financial stability and stress testing.

To get a look, your resume must be a near-perfect match for the job description. Generic applications go straight to the bin. You need to show a crystal-clear track record of delivering results in the exact field they’re hiring for.

The experienced hire track is about proving you’re the solution to a specific problem the IMF has right now. Your application is your argument, and your work history is the evidence. If there’s a mismatch, you won’t get a first look.

This recruitment path values practical, hands-on experience over pure academic credentials. While a Master’s or PhD is usually required, what matters is what you’ve accomplished in your career. The process is similar to applying for a senior role at a central bank or finance ministry. You can find more targeted guidance by reviewing our advice on how to apply for World Bank jobs, as many of the principles are the same.

Consultants and Short-Term Experts

Another major channel for jobs at the IMF is through its consultant and Short-Term Expert (STX) rosters. These are contractual roles designed to bring in specialized expertise for a defined period, usually from three months to a year.

Think of STX roles as the IMF’s special forces. When a member country needs urgent help reforming its banking supervision framework or modernizing its public finance systems, the Fund deploys an STX with that exact skill set. These experts are typically seasoned professionals, often retired from senior positions at central banks, finance ministries, or other international organizations.

Getting on these rosters requires a different approach. The IMF maintains databases of pre-vetted experts in various fields. The key steps are:

Identify Your Niche: Pinpoint your area of deep expertise, like debt management, statistical capacity building, or anti-money laundering.

Monitor Vacancy Announcements: The IMF posts specific consultant opportunities, often for its capacity development programs.

Network Strategically: Connect with IMF department heads and mission chiefs in your field. A strong professional reputation is your best asset here.

The Fund maintains a robust ecosystem of job vacancies that extends beyond the well-known programs. Platforms like Workday list economist pipeline postings twice a year, while a quick look at UN Talent recently showed over 20 open positions for roles in macro-financial analysis and communications in regions from the Pacific Islands to Ukraine. This shows the constant demand for specialized talent. You can find more insights on the variety of IMF roles available across different platforms.

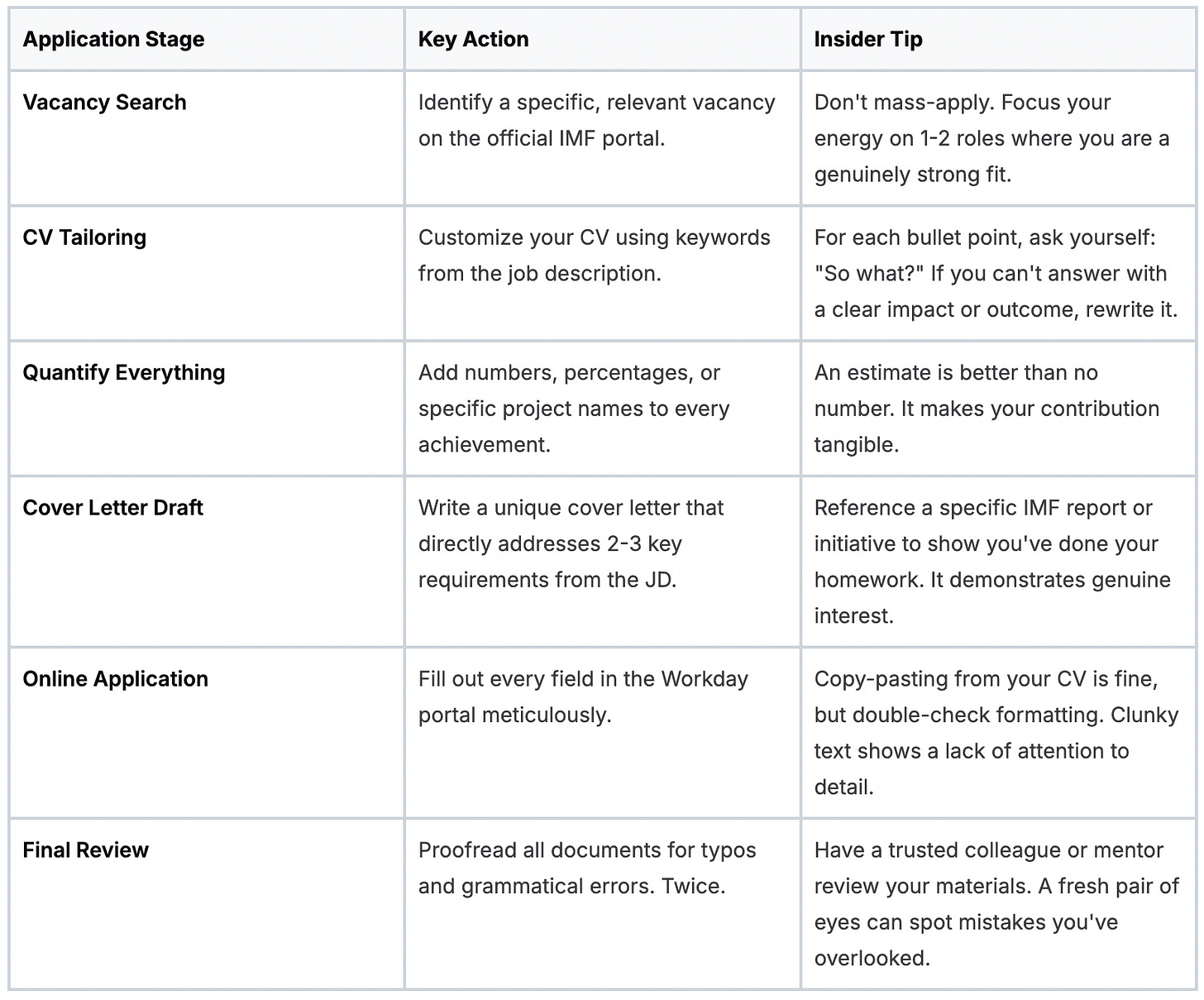

A Step-by-Step Guide to the IMF Application Process

Applying for an IMF job is a precise, unforgiving process. This isn’t a numbers game where you can send dozens of generic resumes and hope for the best. Recruiters look for perfectly tailored documents, and any mistake or misalignment gets you sorted into the “no” pile instantly.

Treat your application like a high-level policy brief for the Executive Board. Every word matters, the data must be flawless, and the document must speak directly to its audience. A sloppy application signals you can’t handle the rigor of the job. Here are the exact steps to build an application that gets a serious look.

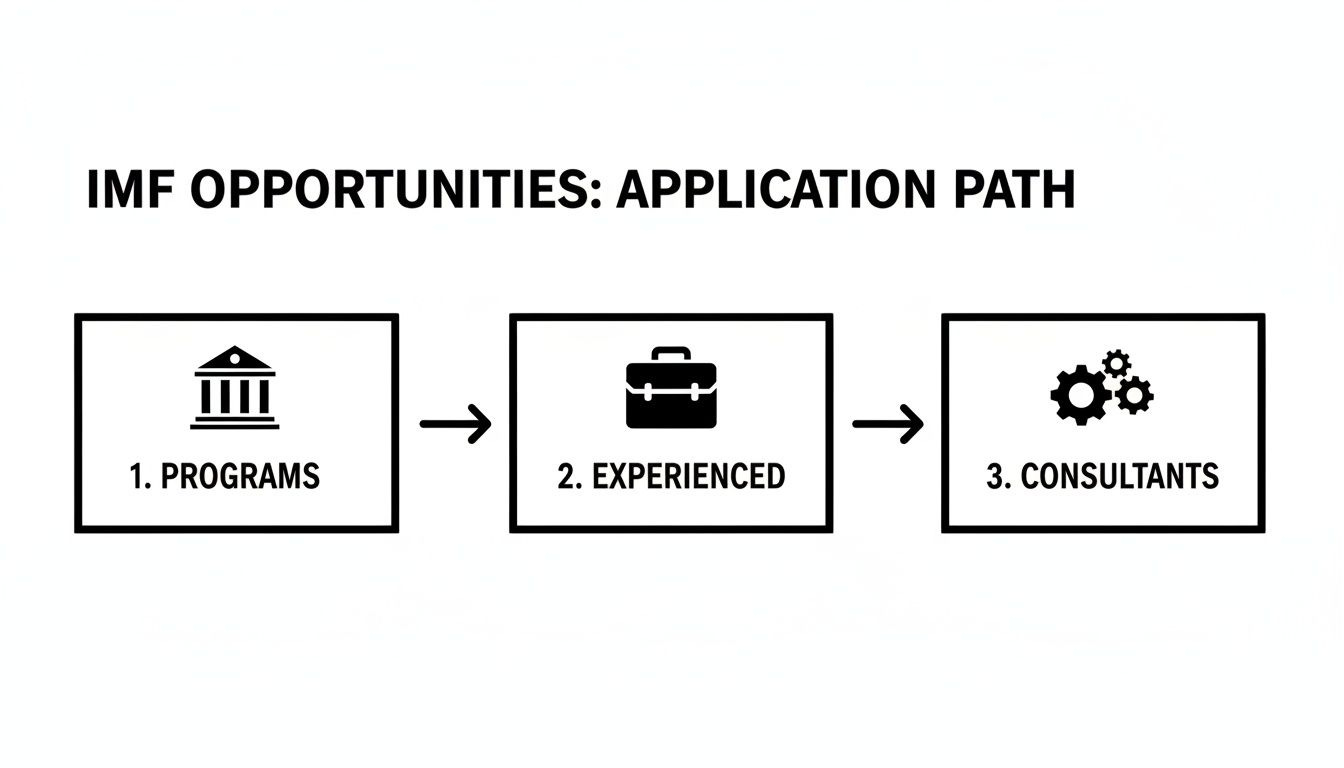

The Fund’s hiring process flows through distinct channels depending on the role. This visual breaks down the main paths.

This flowchart maps the primary career tracks, showing separate entry points for structured programs, experienced hires, and consultants. It’s a clear roadmap of how the Fund organizes its talent intake.

Finding and Tracking Official Listings

Your first and only stop should be the official IMF career portal, which runs on Workday. This is the single source of truth for all current staff and program openings. Bookmark it and check it often. New roles appear based on departmental needs, not on a fixed schedule.

Beyond the official site, monitor job boards specializing in international organizations. Treat these as pointers, not the final destination. You must complete the application through the IMF’s own system.

Here are the key places to look:

IMF Careers Portal: This is mandatory. All applications must go through their Workday platform. No exceptions.

Specialized Newsletters: Publications like MDBjobs consolidate listings from the IMF and other multilateral banks, which saves you time.

Professional Networks: Follow IMF departments and key staff on sites like LinkedIn. They sometimes share high-priority vacancies to their networks.

Never apply through a third-party site. Always go directly to the source to ensure your application is officially submitted and tracked.

Tailoring Your CV and Cover Letter

A generic CV is the fastest way to get rejected. Your resume and cover letter are your argument for why you are the perfect fit for a specific IMF job vacancy. You have to connect the dots for the recruiter.

For your CV, go beyond a simple list of duties. For every role you’ve held, quantify your accomplishments. Make it concrete.

Instead of “Analyzed economic data,” write “Developed econometric models in STATA to forecast GDP growth, contributing to a published country report.“ The first is passive and forgettable. The second demonstrates specific skills and tangible impact.

Your cover letter is your chance to build a narrative. It should directly address the role’s requirements and link your experience to the IMF’s mission of global financial stability. A great cover letter does three things:

Shows You Understand the Role: It proves you’ve read the job description carefully and grasp what the department needs.

Highlights Relevant Skills: It draws a direct line between your quantitative, policy, and international experience and the job’s demands.

Demonstrates Mission Alignment: It conveys your genuine interest in the Fund’s work, not just your desire for a prestigious job.

Avoiding Common Disqualifying Mistakes

The application system is designed to weed people out. Too many candidates are disqualified by simple, avoidable errors before a human even sees their CV.

Here are the most common pitfalls:

Incomplete Applications: Double-check that every required field in the Workday portal is filled out. Missing information can trigger an automatic rejection.

Ignoring Keywords: Use the exact language from the job description in your CV. If they ask for “macroeconomic surveillance,” make sure that exact phrase appears.

Failing to Quantify: Vague claims of success are ignored. Use numbers, percentages, and specific outcomes to prove your value.

A Generic Cover Letter: If your letter could be sent to the World Bank with minor tweaks, it’s not good enough. It needs to scream “IMF.”

Use this checklist before you hit “submit.” It’s your pre-flight check to ensure your application is ready for takeoff.

IMF Application Checklist

Treat the application as your first test. Your ability to follow instructions, present information clearly, and build a compelling case directly reflects the skills you’ll need on the job. A meticulous, tailored application is your only path forward.

The Unspoken Rule: How Nationality and Quotas Affect Your IMF Application

When you apply for an IMF job, your resume is only part of the story. Your nationality is a huge factor. This is a core feature of the Fund as an institution representing 190 member countries.

The IMF constantly works to keep its staff geographically diverse, reflecting the global membership it serves. It actively manages the national makeup of its workforce to ensure no single country or region is overrepresented. It’s a balancing act.

This has real consequences for you. Your passport can be a neutral factor or a hurdle. If you come from a country that already has a lot of staff at the Fund, you face a much steeper climb.

How This “Quota System” Actually Works

The IMF does not have a rigid, public list of quotas. Instead, it uses internal targets to guide hiring and maintain geographic balance. These targets are loosely tied to each member country’s financial contribution to the Fund, known as its “quota.”

This creates a situation where some nationalities are “underrepresented” and others are “overrepresented.” If you’re a candidate from an underrepresented country and you meet the IMF’s tough technical standards, you have a real edge. Recruiters are actively looking for you.

Your nationality alone won’t get you a job. But it can get you a closer look. An excellent candidate from an underrepresented country is a golden ticket for recruiters trying to meet internal diversity goals.

This nationality factor is most important for permanent staff positions, especially for career-launching roles like the Economist Program (EP). For short-term consultant gigs, it’s less of a focus; there, highly specialized skills are king. Even then, nationality can still be a tie-breaker.

So, How Competitive is Your Nationality?

The IMF doesn’t publish a list of over- and underrepresented countries. But you can do some detective work. Look at the senior management profiles on their website and scan staff lists from publications. If you see a lot of people from one country, it’s a safe bet that country is well-represented.

Here’s a practical way to think about it:

The Toughest Pools: If you’re from a large economy known for its top-tier economics graduate programs (think the United States, United Kingdom, France, Germany, and India), you’re in a highly competitive pool. There are simply more of you applying.

The Advantaged Pools: Candidates from smaller developing nations, particularly in Sub-Saharan Africa, certain parts of Latin America, and small island states, are often in high demand. Hiring you helps the Fund improve its geographic balance.

This is the reality of the IMF application process. You have to be strategic. If you’re from an overrepresented country, your application must be flawless. Your technical skills, experience, and passion for the IMF’s mission have to be so compelling that they overcome that built-in structural hurdle.

Why an IMF Career Matters in Today’s Economy

An IMF job puts you at the epicenter of the massive economic shifts happening across the globe. An IMF job vacancy is your ticket to the front lines, helping solve the problems that keep finance ministers and central bankers up at night.

The world is grappling with three huge structural changes at once: rapid technological disruption, the pivot to a green economy, and an uneven recovery from recent shocks.

These are the day-to-day work of IMF staff. Grasping this context is critical when you apply. You must prove you understand these challenges and have the skills to tackle them. The Fund is hunting for candidates who can connect their analytical horsepower to real-world policy dilemmas.

The Skills Needed for a Shifting Economy

Core IMF skills, like macroeconomic forecasting, debt sustainability analysis, and policy design, have never been more critical. The Fund’s work directly shapes how countries navigate these transitions, which means your potential contribution is massive.

Research from the World Economic Forum projects that major labor market transformations will disrupt jobs equivalent to 22% of today’s total employment. While technology and the green transition are expected to create around 170 million new jobs, about 92 million existing ones will be displaced. You can dig into the details in their Future of Jobs Report.

This upheaval creates a huge demand for professionals who can analyze labor market policies, design effective social safety nets, and advise governments on building resilient growth. That’s exactly what the IMF does.

Your application can’t just list credentials. It needs to be a clear, confident statement that you are ready to help solve the world’s most urgent economic problems. If you frame your experience through this lens, your candidacy becomes impossible to ignore.

Positioning Yourself for Impact

When you understand this bigger picture, you can frame your skills in a much more compelling way. As you apply for job vacancies imf, don’t just say you have “data analysis skills.”

Explain how you would use those skills to assess the fiscal impact of a carbon tax or model the employment effects of automation. This shows you’re a forward-thinking economist, not just a technician. It proves you see the big picture and are ready to contribute from day one.

It also helps to think about how different institutions tackle these issues. For a deeper dive, check out our guide comparing the World Bank vs. the IMF vs. the ADB. Proving you get the context of the work is what will elevate your application from good to exceptional.

Common Questions About IMF Job Vacancies

When you look at jobs at the IMF, practical questions always come up. Here are straight answers based on how the hiring process actually works.

What Skills Matter Most on an IMF Application?

Strong quantitative and analytical skills are non-negotiable. You have to prove you are an expert with econometrics and statistical software, especially tools like STATA, R, or MATLAB.

Your ability to write clearly and communicate complex ideas is just as important. Your analysis will directly feed into high-level policy reports, so there’s no room for fuzzy language.

Ultimately, a deep and practical understanding of macroeconomics is the bedrock for almost every economist and research role at the Fund. They expect you to hit the ground running.

How Long Does the IMF Hiring Process Take?

It varies by role, but the short answer is: be prepared to wait.

For structured programs like the RAP or EP, the process can take several months from application deadline to final offer.

For individual experienced hire vacancies, things might move faster, often taking between 6 to 12 weeks.

Patience is a must. The internal approvals and background checks are incredibly thorough and take time. There are no shortcuts.

Can you apply for multiple IMF jobs at once?

Yes, and you should if you meet the qualifications. But be strategic. It’s better to submit two or three highly tailored applications for roles where you are a perfect fit than to spam dozens of openings with a generic resume. Recruiters spot a lazy application from a mile away.

Is a PhD Required to Be an IMF Economist?

This is a common point of confusion. For the flagship Economist Program (EP), the main track for a long-term career as an economist, a PhD is a firm, mandatory requirement. There’s no way around it for that program.

However, many other excellent roles don’t require one. Positions within the Research Analyst Program or certain technical assistance jobs often accept a Master’s degree, especially when it’s backed by significant and relevant work experience.

The rule is simple: always check the specific requirements listed for each job vacancy before you apply.

Ready to find your next opportunity? At Multilateral Development Bank Jobs, we consolidate listings from over 30 MDBs and provide insider guides to help you land the role. Get full-time staff roles on Monday, consultant opportunities on Friday, and career guides every Wednesday. Subscribe today at

https://mdbjobs.com