Jobs at the International Monetary Fund: A Practical Guide to Launch Your IMF Career

Landing a job at the International Monetary Fund is a huge deal. These are some of the most sought-after roles in the global financial system, putting you right at the center of macroeconomic surveillance, crisis lending, and high-stakes policy advice. Getting in is intensely competitive. It demands top-tier qualifications in economics, finance, or public policy, plus a real grasp of what the institution is all about.

What Working at the IMF Actually Involves

Before you draft a cover letter, you need to understand what a career at the IMF truly means. This is a role at the very core of the international monetary system, where your analysis directly shapes the economic fate of entire nations.

Forget theoretical research in an academic ivory tower. This is applied economics in the real world, often under immense pressure.

The Fund’s work boils down to three main functions, and every professional role there supports these pillars. Understanding them is the first step to figuring out where you fit and what recruiters are looking for.

The Core Functions Driving Recruitment

First up is macroeconomic surveillance. IMF teams constantly engage with member countries to keep a finger on the pulse of their economic and financial policies. This means doing deep-dive analysis on everything from fiscal health and monetary policy to the stability of the financial sector. Staff who go on these “missions” are expected to assess risks and give candid, sometimes tough, advice to governments.

Next is lending. When a member country hits a balance of payments crisis, the IMF can step in with financial support. This isn’t free money. The lending comes with conditions, specifically that the country must implement policy reforms to fix the problems that got them into trouble. IMF staff are the ones designing and monitoring these programs, a job that requires a sharp mix of analytical skill and political smarts.

Finally, you have technical assistance and capacity development. The Fund helps member countries build stronger economic institutions. This could mean training central bankers, advising finance ministries on tax policy, or helping develop more reliable statistical systems. It’s practical, hands-on work focused on building long-term resilience.

Your success at the IMF hinges on your ability to translate complex economic theory into actionable policy advice. They’re not looking for academics; they want practitioners who can operate at the intersection of data, policy, and diplomacy.

The Professional Environment and Required Mindset

Working at the IMF means you’ll be surrounded by some of the sharpest minds in global economics and finance. It’s an intellectually demanding, fast-paced, and deeply international environment. You’ll be expected to produce top-quality analysis under tight deadlines and be ready to defend your work in rigorous peer reviews. This is not your typical 9-to-5 job; the work is mission-driven, and the hours reflect that.

The IMF has grown from just 29 member countries in 1945 to 190 members today, and its workforce is just as global. With around 2,700 professionals, recruitment is fierce. To give you some perspective, the Economist Program, a key entry point, often gets over 10,000 applications for only 20-30 spots.

This level of competition means technical excellence is just the entry ticket. The Fund is looking for people with sound judgment, discretion, and a proven ability to thrive in multicultural teams.

While the IMF is zeroed in on macroeconomic stability and the World Bank focuses more on development projects, both need professionals who can navigate incredibly complex institutional landscapes. If you’re exploring careers in this space, you might find our guide comparing the World Bank, IMF, and other MDBs useful.

A job at the International Monetary Fund demands a rare blend of analytical firepower and a genuine commitment to fostering global economic cooperation.

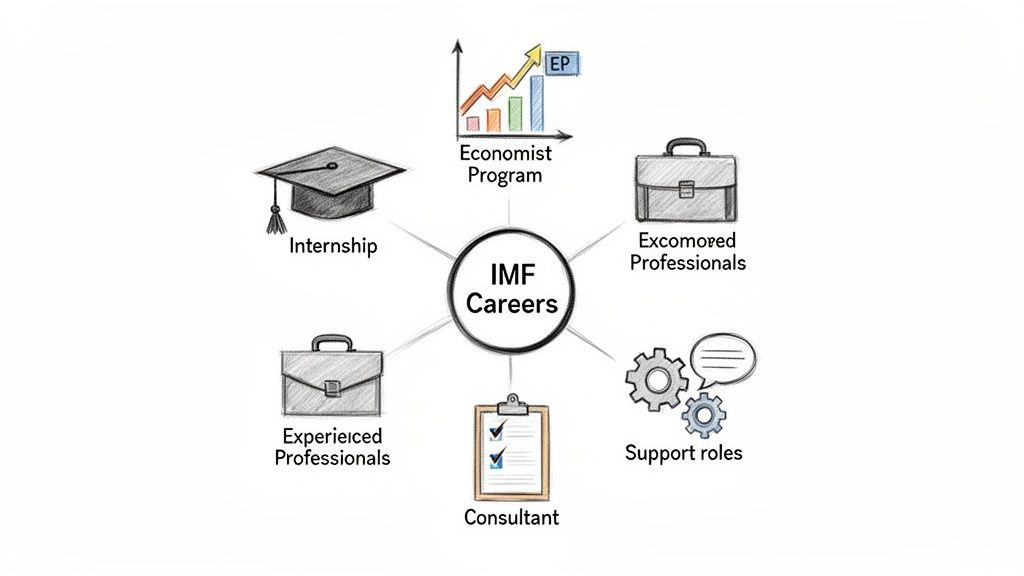

Primary Career Paths and Entry Points

Where do you even start? The IMF isn’t a monolith where you just send a generic CV. It’s a complex institution with specific doors, and if you knock on the wrong one, your application is dead on arrival.

Getting this right is your first big test. You need to honestly map your background, qualifications, and career stage to the right channel. Wasting time on the wrong application stream is the fastest way to get a rejection. Let’s break down the main paths so you can focus your energy where it actually counts.

The Economist Program (EP): The Flagship Path for PhDs

This is the big one. The Economist Program (EP) is the IMF’s premier entry point for freshly minted PhD macroeconomists. If you’re in the final year of your doctorate or have just finished, this is the most prestigious and competitive path into the Fund. It’s designed to be a launchpad for a long-term career.

EPs are hired as full-fledged staff economists from day one. You’ll spend the first three years rotating through different departments, getting a panoramic view of the Fund’s core work. One rotation might have you on a surveillance mission for a G20 country; the next could involve helping design a lending program for an emerging market or writing sections of a Global Financial Stability Report.

The profile they want is razor-sharp:

A recent PhD in macroeconomics or a very closely related field.

Exceptional analytical and quantitative skills, think serious econometric modeling.

A genuine drive to do applied policy work, not just theoretical research.

If you have the academic firepower, the EP is the gold standard. It’s the primary pipeline for the IMF’s economic talent.

The Fund Internship Program (FIP): A High-Stakes Audition

For graduate students, the Fund Internship Program (FIP) is the main way to get a foot in the door. This is a 10- to 12-week intensive program in Washington, D.C., where Master’s and PhD candidates work on real projects alongside IMF staff.

Competition is brutal. Securing a spot is incredibly difficult, with acceptance rates often dipping below 1%. In 2023, the IMF picked just 150 interns from a pool of over 15,000 applicants. The reward is huge, though. Roughly 20% of FIP interns later land full-time roles, often as Research Assistants with starting salaries between $70,000 and $90,000. You can dig deeper into the Fund’s staffing data via their official statistics portal.

A successful internship is one of the most effective ways to position yourself for a full-time job, whether in the EP or another role down the line.

Think of the FIP as a three-month-long job interview. It’s your chance to prove you have the technical chops, the collaborative mindset, and the sound judgment to thrive in the IMF’s high-stakes environment.

Experienced Professional Vacancies: The Mid-Career Route

If you’re past the early-career stage, your main route in is through experienced professional vacancies. These are specific, targeted roles advertised on the IMF careers site for mid-career and senior experts.

This isn’t a structured program. You’re being hired for a particular job in a specific department because you bring a specialized skill set to the table.

This path is perfect for professionals with significant experience in places like:

Central banking

Finance ministries

Regulatory agencies

Other international financial institutions

Relevant private sector roles (e.g., financial markets, risk management)

The IMF also looks for seasoned professionals to fill crucial support functions. These specialized roles are the backbone of the institution and include positions in Information Technology, Communications, Legal, Human Resources, and Finance. Candidates for these jobs need deep expertise, often with experience in an international or public sector context.

Consultant and Contractual Appointments: The Flexible Entry Point

The IMF relies heavily on consultants and contractual staff for specific projects and short-term needs. These roles offer a flexible way to gain exposure to the Fund’s work without the commitment of a full-time staff position.

Consultant gigs can range from a few weeks on a specific assignment to multi-year contracts. They are almost always project-based and call for niche expertise that might not exist in-house. This is a very common entry point for seasoned experts or those transitioning from academia or government who want an inside look at how the institution really works.

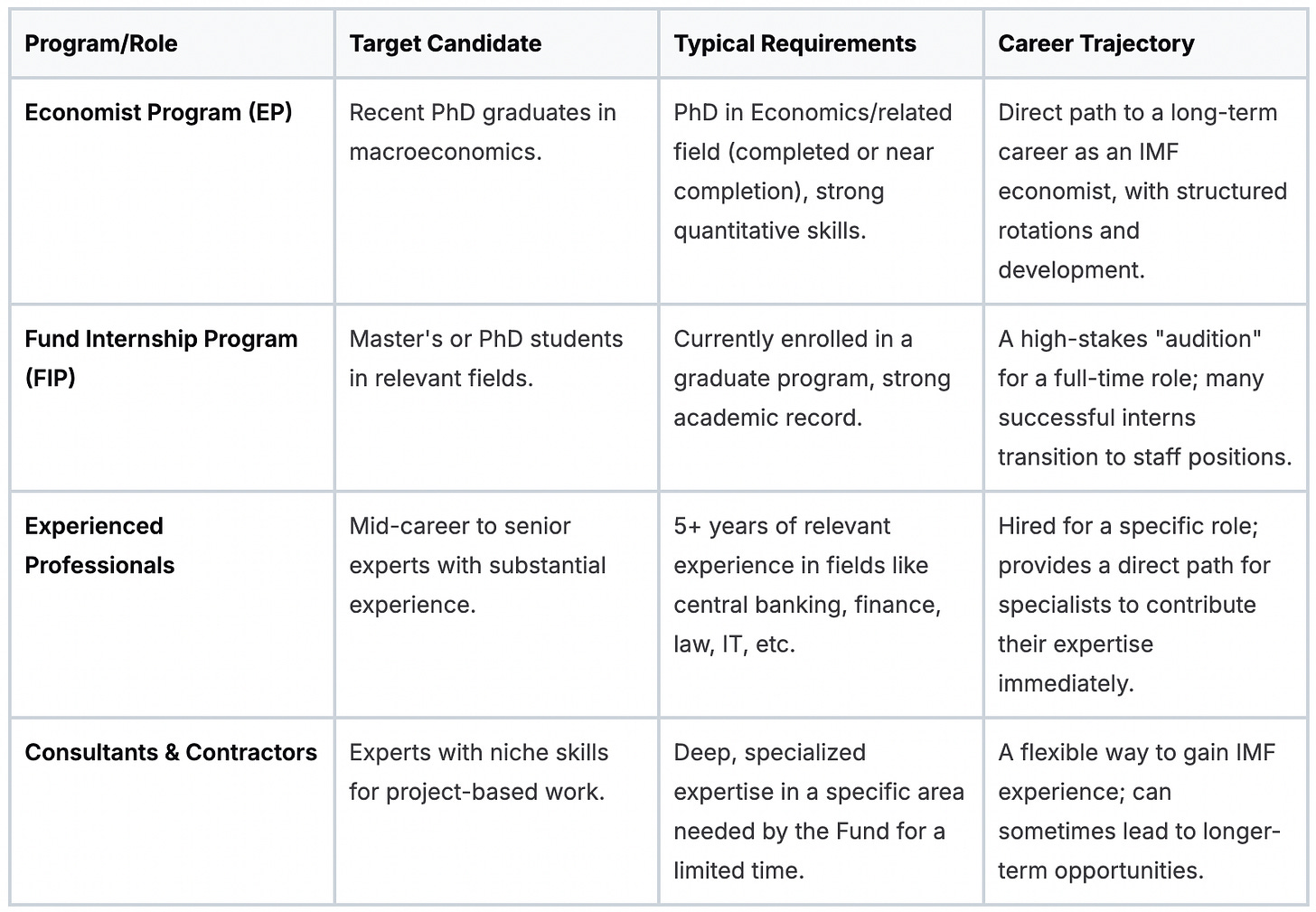

IMF Career Entry Points Comparison

Trying to figure out where you fit? This table breaks down the main entry points to help you pinpoint the best path for your profile.

Each path serves a different purpose. The EP is for building future economic leaders from the ground up, while experienced hires bring in ready-made expertise. Internships are a pipeline for emerging talent, and consultancies provide critical, on-demand skills. Choose the one that aligns with your story.

Making Your Application Stand Out

Sending a generic corporate CV to the International Monetary Fund is a complete waste of time. The Fund lives and breathes a very specific language, the language of macroeconomic policy, fiscal frameworks, and heavy-duty quantitative analysis. If your application doesn’t speak it fluently, it’s going straight to the “no” pile.

IMF recruiters are sharp. They’re trained to spot candidates who genuinely understand the institution’s unique mission. Your job is to present yourself as someone who already thinks like an IMF economist.

This means a total shift in how you frame your experience. They don’t care about maximizing shareholder value or hitting quarterly sales targets. They want to see your ability to analyze a country’s fiscal position, model the impact of economic shocks, and deliver sound policy advice.

Rebuilding Your CV for the Fund

Your CV needs to be an evidence-based document, showcasing the exact skills the IMF is hunting for. Stop listing job duties. Start demonstrating tangible analytical wins. Every line has to be optimized for a recruiter who spends their day sifting through applications from the world’s top policy minds.

Begin with your experience section. Frame each role around key projects and their outcomes.

Here’s what you must prioritize:

Quantitative and Econometric Skills: Don’t be vague. Be explicit. Name the econometric software you’ve mastered, like Stata, R, MATLAB, or Python. Mention the specific modeling techniques you’ve deployed, whether it’s DSGE, VAR, or panel data analysis.

Policy-Relevant Research and Publications: Got papers? Create a dedicated section for them. Highlight any work that touches on fiscal policy, monetary policy, financial stability, or international economics. This is gold.

Cross-Country Experience: The IMF is a global institution. Any work involving cross-country data analysis, research on multiple national economies, or international collaboration is a massive advantage. Make sure it’s front and center.

Data Sources: Show you know the tools of the trade. Mention your hands-on experience with key economic databases like the IMF’s own International Financial Statistics (IFS) and World Economic Outlook (WEO), or data from the World Bank and BIS.

A classic mistake is just listing “data analysis” as a skill. For the IMF, that means nothing. You need to get specific. Instead of that, try: “Conducted cross-country regression analysis using Stata to assess the impact of fiscal consolidation on GDP growth in emerging markets.” That’s the level of detail that grabs attention.

Writing a Cover Letter That Actually Connects

Your cover letter brings your CV to life. It’s not the place to repeat your resume in paragraph form. This is your chance to draw a direct line between your skills and the specific demands of the role and the Fund’s broader mission. A great cover letter proves you’ve done your homework.

Reference a recent IMF report or a blog post from the department you’re applying to. For instance, if you’re targeting the Fiscal Affairs Department, you could mention a recent staff paper on public finance management and connect it to your own work in that space. It shows you’re not just applying blindly; you’re actively engaged with their current thinking.

Keep your letter direct and powerful. The first paragraph should state the exact position and immediately hit them with why you’re a perfect fit. Use the body paragraphs to spotlight two or three of your most relevant qualifications, backing them up with concrete examples that mirror the job description. Wrap it up with a confident statement about how you’ll contribute to the Fund’s work.

Framing Your Experience the Right Way

The final piece of this puzzle is framing. You have to learn to translate your past work into the IMF’s dialect. As I always say in Your practical guide to landing jobs in this sector, it starts with deeply understanding the institution’s priorities.

Look at the difference. Here are two ways to describe the exact same experience:

Corporate Version: “Managed a portfolio of emerging market assets, achieving a 15% annual return.”

IMF-Optimized Version: “Analyzed macroeconomic and financial sector risks in emerging markets to inform investment strategy, specializing in sovereign debt sustainability and capital flow volatility.”

See the difference? The second version screams analytical depth and focuses on the very issues that keep IMF staff up at night. It shows you see the world from their perspective. Applying this lens to every part of your application is what separates the candidates who get an interview from everyone else.

Decoding the IMF Interview Gauntlet

If you’ve landed an interview invitation from the IMF, take a moment. That’s a huge win. It means your CV and cover letter cut through the noise and convinced a hiring manager you have what it takes on paper. Now, the real work begins.

The IMF interview process is a multi-stage marathon designed to test your technical chops, your judgment under pressure, and whether you can collaborate with the high-calibre teams inside the Fund. It’s about how you think and communicate.

Each stage is an elimination round, so you need a clear strategy for every step. Think of it as a series of gates you need to pass through, starting with an initial screening call and often culminating in a high-stakes panel interview or a full-blown assessment centre.

This is your guide to getting through it.

Your CV and cover letter were the entry ticket. They got you noticed, but the interviews are where you prove you can deliver.

The journey usually starts with a brief screening call, maybe with HR or a junior team member. Don’t underestimate this. It’s a quick check to confirm your background and interest, but it’s also your first live audition. Be sharp, articulate, and ready to make a strong first impression.

The Technical Deep Dive: Where They Test Your Substance

Once you’re past the initial screen, expect the technical interview. This is where the gloves come off. For economist roles, this is a test of your expertise in macroeconomics, econometrics, and international finance. Forget abstract theory; they want to see you apply your knowledge to messy, real-world policy dilemmas.

You might be asked to:

Debate the macroeconomic outlook for a specific country and defend your position.

Draft a policy response to a sudden external shock, like a global energy price spike.

Critique a specific econometric model or a recent IMF working paper.

This isn’t the time to be general. You need to be fluent in the core work of the Fund: fiscal sustainability, monetary policy frameworks, financial stability, and sovereign debt. Dive into their recent flagship reports like the World Economic Outlook and the Global Financial Stability Report. Know the current debates.

The Dreaded Case Study and Policy Memo

One of the most intense parts of the process is the practical assessment, which often comes as a case study or a timed policy memo. You’ll get a data packet on a fictional country grappling with economic turmoil and be asked to analyze the situation and recommend a path forward.

This isn’t an exam with a single correct answer. They are pressure-testing your ability to act like an IMF economist.

They want to see if you can:

Synthesize dense, complex information on a tight deadline.

Zero in on the most critical economic vulnerabilities and their root causes.

Formulate policy recommendations that are coherent, defensible, and politically realistic.

Communicate your entire analysis with absolute clarity and precision in writing.

Your analytical framework is what matters. Structure your memo logically, clearly state your assumptions, and use the data provided to back up every one of your recommendations.

The policy memo is a test of both substance and style. Your analysis must be sharp, but your writing must be even sharper. Clear, direct, and jargon-free prose wins the day. This is about proving you can communicate complex ideas to senior policymakers.

The Competency-Based Panel Interview: The Final Boss

If you make it this far, you’ll likely face a panel interview. Picture yourself in a room (or on a video call) with a group of senior staff from the hiring department and other key areas of the Fund. This is the final hurdle, and it will be a mix of tough technical questions and behavioral probing.

The competency-based questions are designed to see if you have the IMF mindset. Be ready to discuss times you’ve worked in a team, navigated professional disagreements, managed a difficult project, or adapted to a completely new environment. Prepare concrete examples using the STAR method (Situation, Task, Action, Result).

The technical questions here are often broader, focusing on your big-picture policy thinking. You might get asked about the future of the international monetary system or the IMF’s role in tackling climate change. You need a thoughtful, well-reasoned perspective. To get a feel for what it’s like on the other side of the table, check out these valuable insights from an interview with an MDB panellist.

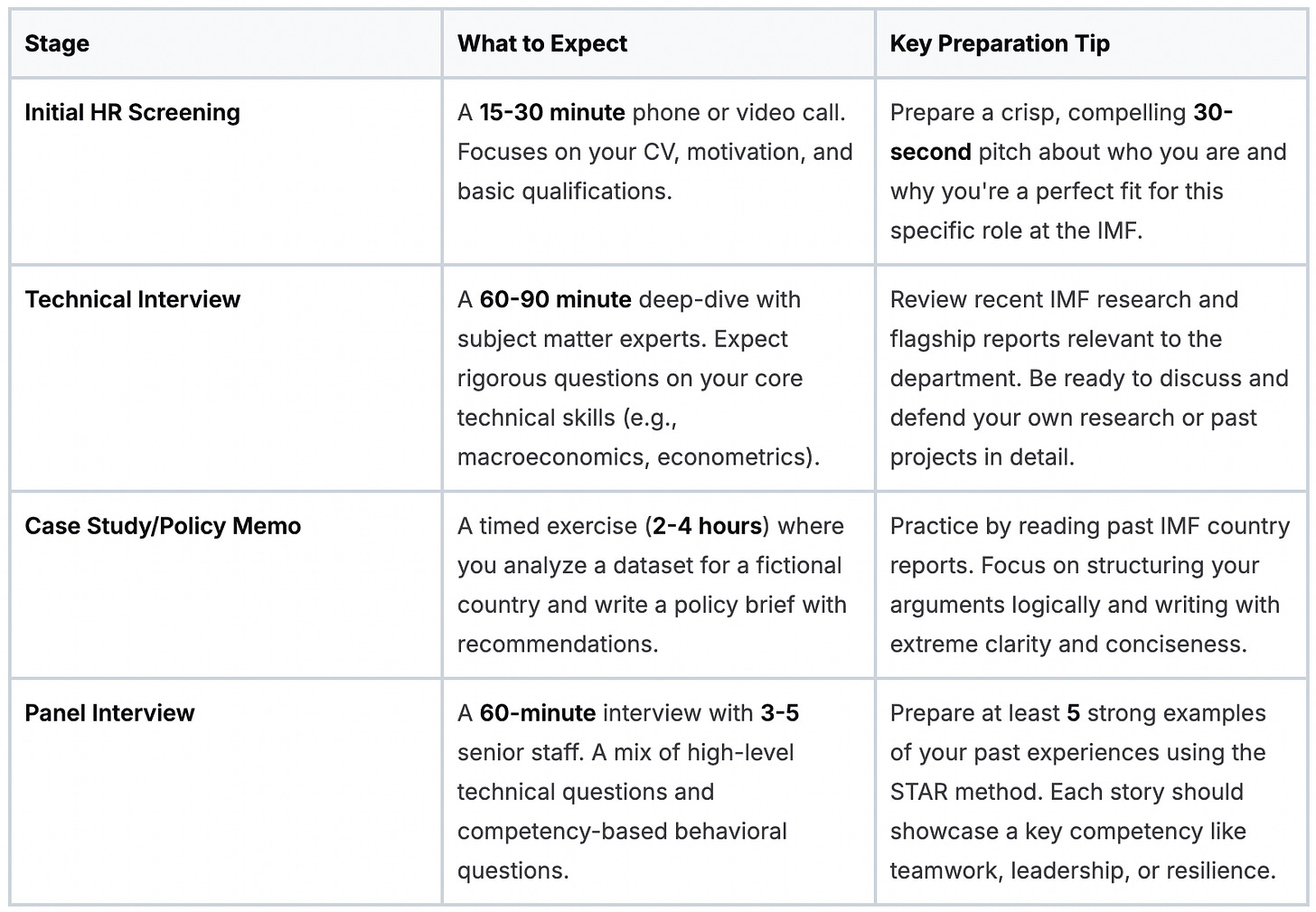

To help you prepare, here’s a quick breakdown of what to expect at each stage.

IMF Recruitment Stages Breakdown

This table summarizes the typical stages in the IMF hiring process and provides a key tip for each phase.

Succeeding in the IMF interview process comes down to meticulous preparation. Master your technical domain, practice your case studies until they become second nature, and have your behavioral stories ready to go. It’s an incredibly demanding process, designed that way to find the absolute best.

Let’s talk about one of the most misunderstood parts of getting a job at the International Monetary Fund: your passport.

It’s a sensitive topic, but ignoring it means you’re flying blind. This is about an institutional mandate to build a staff that actually looks like its global membership. It’s a core part of the IMF’s DNA.

The Fund’s founding document, the Articles of Agreement, is crystal clear. It states that hiring should secure the “highest standards of efficiency and of technical competence” while also paying “due regard to the importance of recruiting personnel on as wide a geographical basis as possible.” This isn’t a friendly suggestion; it’s a foundational rule. With 190 member countries, the IMF is legally and philosophically bound to pursue geographic diversity.

Merit is always the main event. A weak candidate from an underrepresented country will not beat out a rockstar from a well-represented one. But when you have two equally brilliant candidates, and at this level there are many, nationality can and often does become the deciding factor.

Cracking the Quota System

What does this look like in practice? It’s not a rigid system where specific jobs are earmarked for certain nationalities. Think of it more like a dynamic balancing act. The IMF’s HR department keeps a close eye on staff representation from each member country, measured against that country’s financial contribution (its “quota”) to the Fund.

This creates a constantly shifting landscape of “underrepresented” and “overrepresented” countries.

Underrepresented Countries: If you’re a citizen of a country with fewer staff members at the Fund than its quota suggests, you have a slight but very real edge. Recruiters are actively encouraged to find and advance qualified candidates from these nations to help restore balance.

Overrepresented Countries: On the flip side, if your country already has a large number of staff, the bar is implicitly higher. You need to be truly exceptional to stand out because you aren’t helping the Fund hit its diversity targets.

This isn’t a backroom secret. The IMF regularly publishes data on staff diversity, giving you a good idea of where different regions and countries stand. A little digging can help you manage your expectations.

This policy is about ensuring the institution benefits from a kaleidoscope of global perspectives. An economist from a small island nation brings a different and invaluable lens to a policy discussion than one from a G7 country. The Fund needs both to be effective.

What This Means for Your Application

How do you play your cards right with this information?

First, be realistic about where you stand. If you’re from a traditionally overrepresented country, think the United States, Germany, France, or the United Kingdom, you have to bring your absolute A-game. There is no room for error. Your technical skills, policy experience, and interview performance must be flawless.

If you’re a citizen of an underrepresented country, you should recognize this as a genuine advantage. It doesn’t mean you can slack off on your CV or bomb the interview. It just means that if you are a strong, well-qualified candidate, you are precisely the kind of person the Fund is actively looking for to balance its staff profile.

This focus on geographic diversity applies across all levels and roles, including the fiercely competitive entry-level programs. The goal is to build a workforce that is truly international from the ground up, reflecting the global economic challenges the Fund is meant to solve.

Ultimately, your skills and qualifications are what get you in the door. Understanding the institutional imperative for geographic balance gives you the complete picture of how hiring decisions are really made at the IMF.

Common Questions About IMF Careers

Trying to land a job at the International Monetary Fund can feel like navigating a maze. A lot of the same questions pop up time and time again from ambitious candidates. Let’s cut through the noise and get you straight answers.

Do I Need a PhD in Economics to Work at the IMF?

This is the big one. The short answer is: it depends.

For the flagship Economist Program and most senior economist roles, a PhD in macroeconomics (or a very closely related field) is non-negotiable. Think of it as the entry ticket for those core policy and research jobs that are the heart of the Fund’s mission.

But here’s what many people miss: the IMF is a huge organization. A PhD isn’t a universal key to every door. The Fund is constantly looking for specialists with master’s degrees for critical roles in finance, law, statistics, communications, and IT.

For seasoned professionals, years of high-level, relevant experience, say at a central bank or a finance ministry, can be just as powerful as a doctorate. They value real-world policy chops immensely.

What Is the Work-Life Balance Like?

The work is intense. A career at the IMF, especially if it involves country missions or high-stakes negotiations, is not your average 9-to-5. You’re stepping into a high-performance culture where excellence is the baseline, and the pressure can be significant.

The intensity isn’t uniform across the entire institution. Roles tied directly to lending programs or surveillance missions will have grueling periods of long hours and heavy travel. On the other hand, some internal research or support functions might offer a more predictable rhythm.

The Fund provides excellent benefits and leave policies to help, but you need to go in with your eyes open. It’s a mission-driven environment, and that mission often operates around the clock.

The IMF’s work is global and never really sleeps. While the institution provides strong support for its staff, the core expectation is a deep commitment to delivering world-class analysis, often under serious pressure.

How Important Is Speaking a Second Language?

Fluency in English is the absolute baseline; it’s the working language of the Fund. Every official report, meeting, and email is in English, so your professional command of it needs to be flawless.

Proficiency in another language is a major advantage that can really make your profile stand out. This is especially true for staff who go on missions and need to engage directly with officials in member countries.

Languages that will give you a serious edge include:

French

Spanish

Arabic

Russian

For certain country-facing roles, fluency in a specific regional language might even be a hard requirement. It shows a capacity for deeper, more nuanced engagement, and hiring managers know it.

What Happens After I Submit My Application?

This is where you need to cultivate some patience. Once you hit “submit” on the IMF’s portal, your application first lands with Human Resources for an initial screening. They’re checking off the basic boxes: eligibility, required qualifications, and general alignment with the role.

If you make it past that first gate, your profile gets sent to the actual hiring department. This is where the real review happens, with subject matter experts digging into the details of your experience. Because of the sheer volume of applications the Fund gets, this stage can take anywhere from several weeks to a few months.

Only the shortlisted candidates will be contacted for an interview. It’s a good idea to monitor your application status through the online portal, but don’t get discouraged if you don’t hear back right away. The process is slow because it’s incredibly thorough.

Navigating the world of MDB recruitment is complex, but you don’t have to do it alone. Multilateral Development Bank Jobs delivers curated job lists, insider guides, and expert advice directly to your inbox, giving you the clarity and focus needed to land your dream role. Subscribe for free to get weekly staff and consultant opportunities from over 30 MDBs at https://mdbjobs.com