A Guide to UN Staff Benefits and Compensation

When you get a job offer from the UN, the compensation part can look strange. It’s not a single salary number, which is where most people get tripped up. I’m going to cut through the jargon and get straight to what your offer means for your bank account.

First, stop thinking about a single salary figure. A UN paycheck is a package. Your total pay, which they call net remuneration, is built from two core pillars: a base salary and something called post adjustment. Grasping how these two work together is the key to decoding everything else.

The Two Pillars of Your UN Paycheck

The entire UN pay system is built on a powerful idea: equal pay for equal work, no matter where you are in the world. To make this a reality across dozens of countries with different economies, they split your pay into two distinct parts.

First is the base salary. This is a globally consistent number tied to your professional grade, like P-3, P-4, or D-1. A P-3 staff member has the same base salary whether they are in New York, Nairobi, or Rome. Think of it as the foundation of your pay. It’s not the amount you take home.

Second is the crucial part: the post adjustment. This is the variable piece that makes the system work. It’s a multiplier applied to your base salary to account for the cost of living in your specific duty station.

Post adjustment is a financial equalizer. It’s a carefully calculated allowance that ensures your net salary gives you the same purchasing power as a colleague at your level working at UN Headquarters in New York.

For example, a city like Copenhagen has a high post adjustment multiplier because it’s expensive. A duty station in a country with a lower cost of living has a smaller multiplier. This system ensures you aren’t financially penalized for taking a posting in a high-cost city. It’s about fairness.

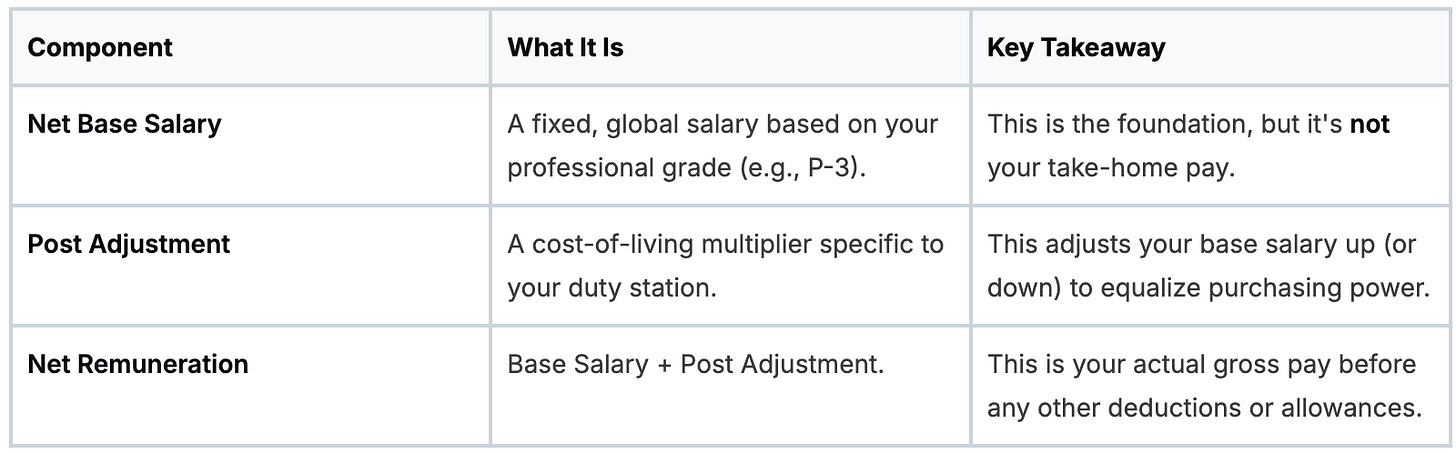

Here’s a quick cheat sheet on how the main components break down:

Once you understand how the fixed base and the variable post adjustment combine to create your total remuneration, the rest of the UN benefits package makes sense. It’s the bedrock for all other allowances and benefits.

Understanding Base Salary and Post Adjustment

Let’s get into the numbers. The core of your UN pay is a two-part equation that balances global consistency with local reality.

The first piece is your net base salary. This is determined by a single, unified salary scale that applies to every professional staff member across the globe. It means a P-3 professional earns the same base salary whether they are posted in Geneva, Bangkok, or Santiago. This scale is the fixed part of your pay that ensures the value of your work is recognized consistently system-wide.

The Role of the International Civil Service Commission

The International Civil Service Commission (ICSC) manages this global scale. The ICSC is the independent body that regularly reviews and adjusts the scale to keep it competitive and fair.

For instance, the ICSC’s 2025 report recommended a 1.6% adjustment to the base salary scale, with an estimated financial impact of around $971,000 for the UN system. These adjustments often involve raising the base salary while tweaking the post adjustment multiplier, which keeps the final take-home pay relatively stable. It’s a constant balancing act. You can dig into the details in the full ICSC report if you’re curious.

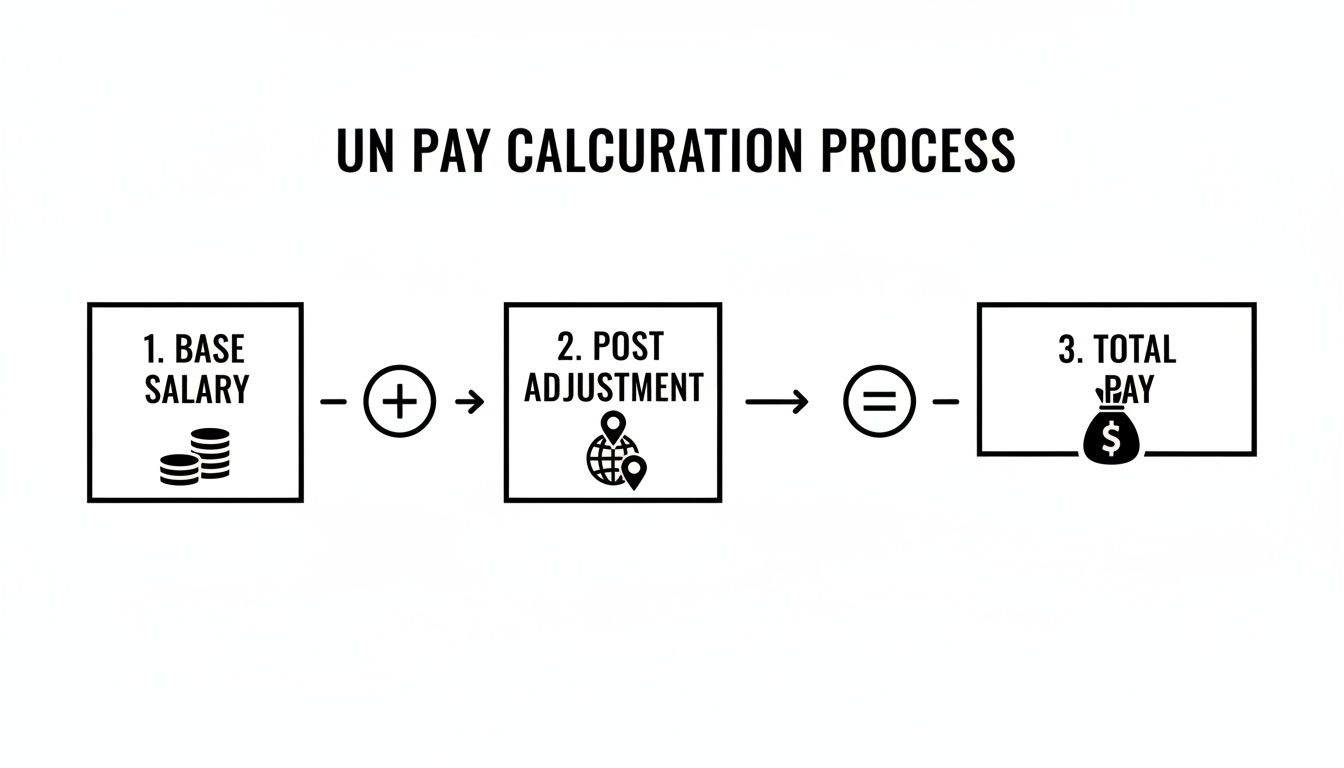

This flowchart breaks down the basic calculation clearly.

It’s a straightforward process: your fixed base salary is combined with the variable post adjustment to determine your total pay.

Post Adjustment: The Great Equalizer

The second, more dynamic part of your pay is the post adjustment. This is a multiplier applied to your base salary that is completely unique to your duty station. Its entire purpose is to equalize your purchasing power.

In simple terms, it ensures your salary goes just as far in an expensive city like London as it would in a less costly one like Nairobi. Think of your base salary as the “what” (your professional value) and the post adjustment as the “where” (the cost of living at your post).

The post adjustment delivers on the UN’s promise of equal pay for equal work. It ensures that a high cost of living doesn’t penalize you financially, making your net remuneration fair regardless of your assignment location.

New York serves as the baseline for the post adjustment, set at a multiplier of 100. Every other duty station is measured against it. A city with a higher cost of living will have a multiplier above 100, while a less expensive one will be below. This can dramatically change your take-home pay, or what the UN calls your net remuneration.

For those comparing opportunities, Multilateral Development Banks (MDBs) often have different systems, which you can explore in our complete World Bank salary guide.

How to Calculate Your Potential Pay

To get a realistic idea of your monthly pay, you need the current post adjustment multiplier for your potential duty station. The ICSC is the official source for this data, and it’s essential to use their latest figures.

You can find all the latest post adjustment information on the ICSC’s website. They publish circulars regularly with updated multipliers.

Once you have the multiplier for your city, the calculation is direct:

Find your grade’s annual base salary on the official UN salary scale.

Divide by 12 to get your monthly base salary.

Find the post adjustment multiplier for your city from the latest ICSC circular.

Calculate the post adjustment amount: (Monthly Base Salary) x (Post Adjustment Multiplier / 100).

Add them together: Monthly Base Salary + Post Adjustment Amount = Your Monthly Net Remuneration.

This final number is the most critical for your financial planning and gives you a clear picture of what you’ll take home each month.

The Allowances That Build Your Total Package

Your base salary and post adjustment are the starting point. The real story of a UN compensation package is in the allowances.

These are carefully designed financial tools that address the realities of a career in international service. They recognize that you have a family, that you might be posted somewhere tough, and that the organization needs you to be globally mobile. Understanding these shows you the full picture, which turns a good salary into a genuinely supportive financial package.

Allowances for Your Family

The UN understands that you can’t do your best work if your family isn’t stable, especially when you’re posted thousands of miles from home. Dependency allowances offer direct financial support for your spouse and children.

These are not tied to your location. They are paid as flat global amounts, which keeps things simple and fair no matter where you are.

The children’s allowance is a social benefit designed to provide consistent support. The amount is calculated by taking a weighted average of the dollar figures at major headquarters duty stations. For instance, the reference amount set back in 2011 was $2,929 per child, per year, derived from averaging figures across eight key locations. If you’re curious, you can explore the methodology in more detail to see how these rates are set.

This system means the support you get for your kids is predictable, whether your assignment takes you to Geneva or Nairobi. It’s a core part of the UN’s family-friendly approach.

Compensation for Difficult Postings

Let’s be real: a UN career can mean serving in places with serious challenges. The hardship allowance is the UN’s way of acknowledging that. It’s direct financial compensation for taking a job in a location with significant health risks, security threats, or extreme isolation.

The International Civil Service Commission (ICSC) classifies every duty station on a scale from H (for headquarters) down to E (the most difficult). If you are posted in a location rated A through E, you get a hardship allowance.

Think of the hardship allowance as risk pay. The tougher the environment, the higher the allowance. It’s a clear financial incentive for taking on some of the UN’s most demanding assignments.

This allowance is calculated as a percentage of your net base salary, and that percentage climbs with the hardship level of the duty station. It can be a substantial addition to your monthly income, directly reflecting the difficulty of the environment you and your family are living in.

Incentivizing Global Mobility

A UN career isn’t meant to be static. The system relies on an experienced workforce that can move between countries, roles, and missions. The mobility incentive encourages and rewards exactly that.

It’s a payment for internationally recruited staff who have put in five straight years of service. The key is that you must have served in at least two different duty stations to get it.

Here’s the breakdown:

Eligibility: You’re in the running after your second assignment.

Calculation: The amount depends on your grade, your dependency status, and how many assignments you have completed.

Purpose: It’s a financial thank-you for your flexibility and willingness to serve in different corners of the world, which is vital for the UN’s work.

This incentive is a cornerstone of the UN benefits system because it underpins the idea of an “international” civil service. The UN recognizes that uprooting your life every few years comes with real costs, and it provides a concrete reward for your commitment. Together, these allowances create a compensation package that’s far more robust than the base salary alone suggests.

Securing Your Future with UN Benefits

Allowances are just one part of the story. The core UN staff benefits package is where the real long-term value lies. This is about building a secure financial future for you and your family, no matter where your career takes you.

Getting a handle on these three pillars of pension, health insurance, and education support is essential. They represent the UN’s significant investment in its people and are often the deciding factor for candidates comparing a UN offer to one from the private sector or even other public institutions.

The UN Joint Staff Pension Fund

The UN Joint Staff Pension Fund (UNJSPF) is the single most valuable perk of a UN staff career. It’s a defined-benefit pension, a type of plan that has become incredibly rare in the private sector. This means your future retirement income is based on a set formula, not the whims of the stock market.

You contribute a fixed percentage of your pensionable remuneration, and the UN chips in more than double your amount. After five years of service, you are “vested,” which means you officially have a right to a future retirement benefit. This predictable, secure income stream is the cornerstone of long-term financial planning for UN staff.

One of the most powerful features of the UNJSPF is its built-in protection against inflation. Your pension isn’t a static number that loses value over time; it maintains its purchasing power throughout your retirement.

This is managed through a cost-of-living adjustment (COLA) mechanism. The fund uses an indexed system and applies adjustments whenever the Consumer Price Index (CPI) moves by at least 2%. For instance, for the 2025 cycle, the UNJSPF announced a 2.8% COLA to the U.S. dollar track of benefits, showing its commitment to protecting retirees’ income. You can read more about the latest adjustment figures directly from the pension fund.

Comprehensive Global Health Insurance

The UN provides comprehensive, globally-accepted health insurance plans for staff and their eligible family members. This is another massive benefit, especially for anyone who moves between countries frequently.

The plans are typically premium-sharing, meaning both you and the organization contribute to the cost. They offer robust coverage that works across borders, so you are covered for medical and dental care whether you are at a headquarters city like New York or a field office in a remote region. This eliminates the headache of finding new insurance with every move and ensures your family has continuity of care.

This benefit is also a major difference when compared to the tax status of employees at some other international organizations. You can learn more about why MDB employees pay no taxes in our related guide.

The Education Grant

For internationally recruited staff with children, the education grant is a game-changer. It’s a substantial benefit designed to help cover the costs of sending your kids to international schools, making sure they receive a consistent, high-quality education no matter your duty station.

Here’s a quick rundown of how it works:

Eligibility: It’s available for eligible children in primary, secondary, or university education.

Coverage: The grant reimburses a significant percentage of education costs, up to a specific maximum amount per child, per school year.

Purpose: The goal is to offset the high costs of international schooling so that your children’s education isn’t disrupted by your international career.

This grant makes it financially possible for many families to accept postings in locations where the local school system might not be suitable. It’s a direct investment in the well-being and future of your family, and it’s a critical piece of the total UN benefits package that supports a mobile, global workforce.

Why Your UN Contract Type Matters

Not everyone working for the UN is a “staff member.” This is the single most important thing you need to understand when looking at UN staff benefits, because the entire package we’ve covered applies specifically to one group.

If you don’t get this distinction right, you could be in for a massive financial shock. The incredible pension, health insurance, and allowances are all tied to staff contracts like Fixed-Term, Continuing, or Permanent appointments. A huge number of people on UN projects hold very different contracts, and their compensation is a completely different world.

The Consultant Reality: No Health Insurance, No Pension

A lot of professionals get their foot in the door at the UN as a consultant, often on what’s called an Individual Contractor Agreement (ICA) or something similar. These roles are everywhere, but the pay structure is completely different from a staff position.

As a consultant, you get a lump-sum fee for your work. That’s it.

This fee is an “all-in” amount. You must sort out and pay for your own health insurance, pension contributions, and any time off. The UN does not provide any of these benefits to individual contractors.

This model gives the organization flexibility for short-term projects, but it shifts all the long-term financial responsibility onto you. You’re effectively running your own small business and selling your services to the UN. For a deeper look, our guide on the differences between consultant and full-time employee roles in MDBs covers very similar ground.

The UN Volunteer Package: A Different Approach

Another common way people work with the UN is as a United Nations Volunteer (UNV). While it’s an incredible opportunity to contribute to global projects, it is not a staff position, and the benefits package reflects that.

UNVs receive a package designed to support them during their assignment, not to build long-term wealth. It usually includes:

Monthly Living Allowance: A modest stipend meant to cover basic living costs at the duty station.

Health and Life Insurance: You get coverage, but only for the duration of your assignment.

Travel and Settling-In Grant: Financial help to get you to your duty station and set up your new life.

There’s no contribution to the UN pension fund and you won’t get dependency allowances in the same way a staff member would. The UNV program is built on a spirit of volunteerism, and the benefits package is structured to enable that service, not to provide a career compensation package.

A Comparison of UN Contract Types

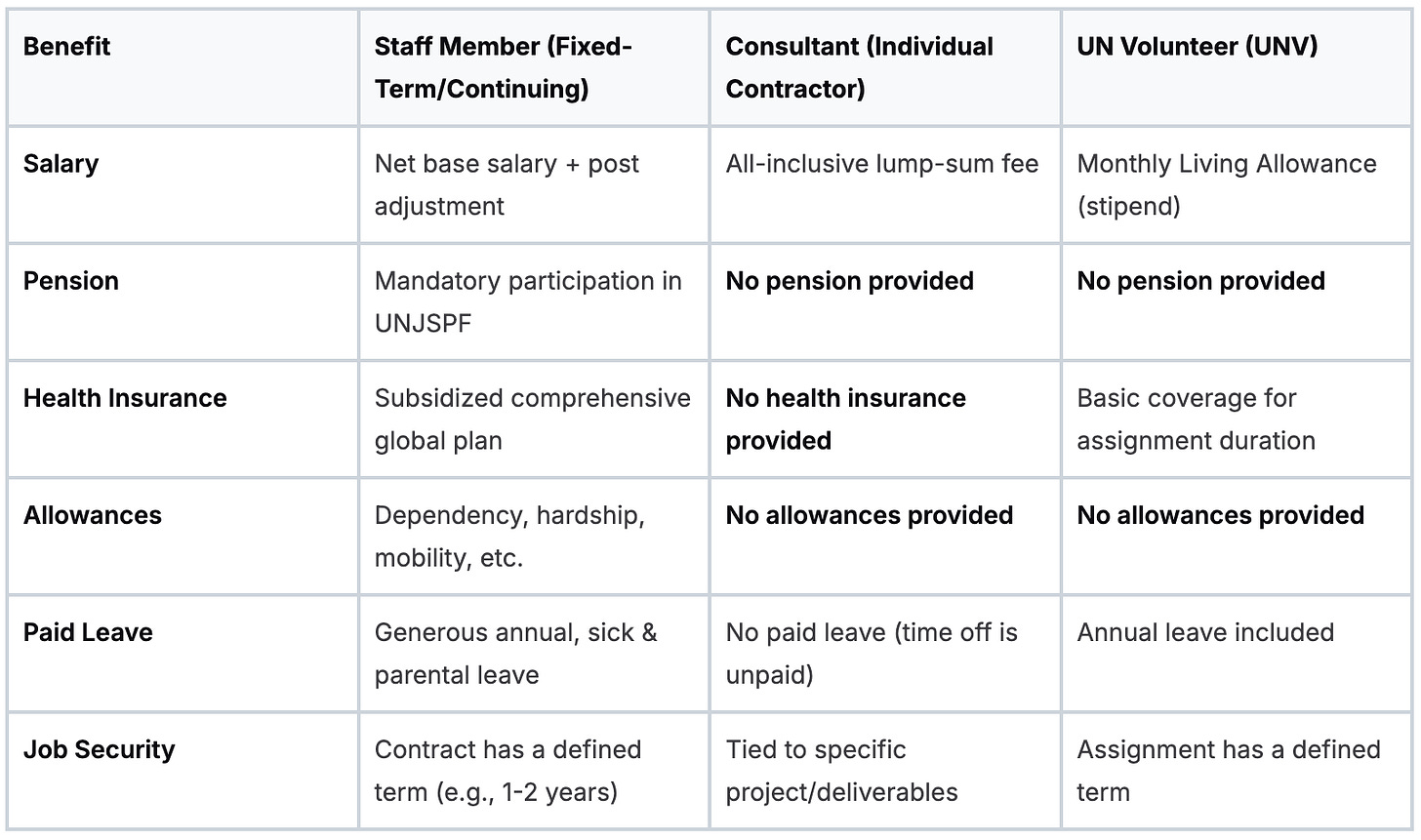

To make this crystal clear, let’s break down how the benefits stack up across the main contract types you’ll encounter. The differences are stark.

This table drives the point home. An “opportunity with the UN” can mean vastly different things depending on that contract. Knowing the difference is vital. It stops you from misinterpreting an offer and helps you target the roles that match your financial and career goals. Now you know exactly what to look for.

How to Properly Evaluate a UN Job Offer

You have the offer letter in hand. Congratulations. Now for the tricky part: figuring out what this package is actually worth, especially when you stack it up against your current job or another offer.

To get this right, you have to look past the base salary and build out the entire financial picture. This is where most people get it wrong.

First, let’s talk taxes. For most nationalities, your UN salary is tax-exempt in your home country. This is a massive deal. A private sector salary of $100,000 is not the same as a tax-free UN net remuneration of $100,000. Forgetting this simple fact is the single biggest mistake people make when comparing offers.

This tax advantage dramatically boosts your real take-home pay. You absolutely must compare your potential UN net income against your after-tax private sector income for a meaningful comparison.

Building Your Financial Model

The only way to see the full value is to create a simple spreadsheet. Don’t just eyeball the numbers. Map them out line by line to get a clear, honest comparison between your current role and the UN offer. This is how you move from a vague idea to a concrete financial decision.

Your goal is to calculate your total potential UN income and compare it to your current total compensation. It’s a straightforward but essential exercise.

Here’s a simple breakdown for your spreadsheet:

UN Net Remuneration: This is your base salary plus the post adjustment for your duty station. Think of this as your core take-home pay.

Key Allowances: Add separate lines for dependency allowances (spouse, children), any hardship allowance if applicable, and other entitlements mentioned in your offer.

Non-Cash Benefits: You have to factor in the long-term financial impact. The UN’s contributions to your pension and health insurance are significant.

You are not just comparing salary to salary. You are comparing a comprehensive benefits package against a simple paycheck. The UN pension alone is a powerful wealth-building tool that most private sector jobs cannot match.

Seeing the Total Value Proposition

Once you have laid everything out, the true value of the UN staff benefits becomes crystal clear. You will see how allowances can add a significant chunk to your monthly income. You will also see how the pension acts as a forced savings and investment plan, steadily building your net worth over time.

This is about total compensation, long-term security, and benefits that directly support your family’s well-being, like the education grant.

By modeling it all out, you give yourself the hard data needed to make a smart, informed career choice. This structured approach prevents you from undervaluing a UN offer by just looking at the salary number on the first page.

I get a lot of questions about how a UN package really works. Let’s tackle some of the most common ones so you have the straight answers you need.

Are UN Salaries Really Tax-Free?

Yes, for the most part. Your UN salary is typically exempt from national income tax, a rule set by the 1946 Convention on the Privileges and Immunities of the United Nations. This is not a blanket rule that applies to everyone.

The big exception is for U.S. citizens, who are still on the hook to pay taxes to the U.S. government on their UN earnings. To level the playing field, the UN has a tax equalization program that reimburses them for these payments, making sure they do not end up with less take-home pay.

The bottom line: Always check your home country’s specific tax treaty status on UN income before you make any assumptions.

Do These Benefits Apply to Consultants?

Absolutely not. This is the most critical distinction to understand. The comprehensive UN staff benefits package of pension, health insurance, and paid leave is exclusively for staff members on contracts like Fixed-Term or Continuing appointments.

Consultants are brought on as independent contractors. They get an all-inclusive fee and are entirely responsible for sorting out their own taxes, insurance, and retirement plans. It’s a completely different financial world.

When you’re looking at a UN role, the first question to ask is, “What’s the exact contract type?” The answer changes absolutely everything about the compensation.

Can My Family Get Benefits Too?

Yes. The UN system is built with families in mind. Your eligible dependents, usually your spouse and children, can be covered under your UN-sponsored health insurance plan.

On top of that, you’ll get dependency allowances, which are flat-rate amounts added to your monthly income. For international staff, the education grant is another massive perk that helps cover your kids’ schooling costs. These family-focused benefits are a huge part of the total value of a UN offer.

At Multilateral Development Bank Jobs, we go beyond the job board to give you the insider knowledge needed to land a role in the world’s top international organizations. Subscribe to get curated job lists and deep-dive career guides delivered straight to your inbox. Find your next opportunity at

https://mdbjobs.com

.