European Development Bank Jobs: A Guide to Getting Hired

Landing a job at a European development bank requires more than a polished resume. It demands strategy. The biggest mistake people make is treating these banks like they’re all the same. They’re not. Your first move is to stop thinking of them as one big monolith and start seeing them as individual institutions, each with its own mission.

Mapping the European Development Bank Landscape

Before you apply, you need to get the lay of the land. The European development finance scene has a few major players, and each one has its own culture, geographic focus, and project priorities. Firing off a generic application is the quickest way to the “no” pile.

A heart surgeon doesn’t apply for a job in a dermatology clinic. The basic medical knowledge is there, but the core specialty is completely different. The same logic applies here. You have to match your skills and experience to the bank’s specific goals.

The Major Players and Their Missions

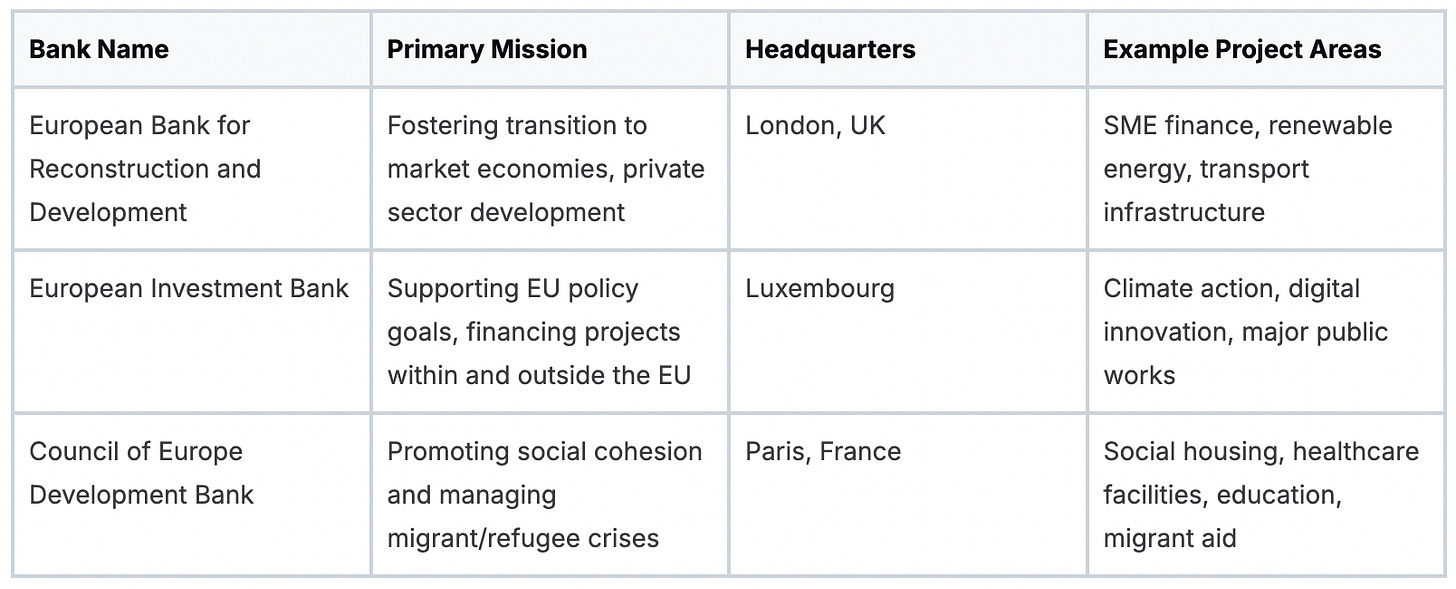

Let’s break down the three big ones. Nailing the differences between them is the foundational knowledge you need to make your job search count.

European Bank for Reconstruction and Development (EBRD): The EBRD helps countries transition to open, market-driven economies. It’s heavily focused on building up the private sector in places like Central and Eastern Europe, Central Asia, and the Southern and Eastern Mediterranean. If you have a background in private equity, SME finance, or sustainable infrastructure, the EBRD should be at the top of your list.

European Investment Bank (EIB): As the European Union’s lending arm, the EIB’s work is directly tied to EU policy. Its projects zero in on climate action, innovation, infrastructure, and supporting small businesses, mostly within the EU but with a global reach too. Jobs here often demand a solid grasp of EU policy and experience with large-scale public infrastructure financing.

Council of Europe Development Bank (CEB): The CEB is unique because of its strong social mandate. It funds projects that boost social cohesion: things like social housing, healthcare, education, and support for refugees and migrants. If your expertise is in social policy, public health, or migration issues, the CEB’s mission is a natural fit.

The number one mistake candidates make is sending an application that isn’t tailored to the bank’s specific mission. An application that screams “EIB infrastructure” will fall completely flat at the socially focused CEB. Your success hinges on proving you understand the difference.

This simple breakdown shows how these institutions differ.

Major European Development Banks at a Glance

This table compares the primary focus, headquarters location, and typical project areas for the top European development banks. Use it to quickly identify which ones align with your career interests.

Getting a feel for these distinctions is your first step. It lets you move beyond being another applicant and become a candidate who clearly knows where they fit.

The EBRD’s Focus on Transition Economies

The EBRD is very clear about its niche. A quick look at its website highlights its work in regions going through major economic shifts.

This visual focus on specific projects and regions tells you everything. The bank’s identity is wrapped up in delivering tangible results in its countries of operation. That’s a huge clue that they’re looking for candidates who can point to direct, project-level impact.

Established in 1991 after the Cold War, the EBRD has been a key driver of job creation in Europe’s emerging markets. For anyone targeting an EBRD role, this history matters. It shows the value of specializing in transition economies, where post-1991 commitments have created long-term hiring needs.

This targeted approach means your generalist experience is less valuable than specialized knowledge in, say, green energy finance for the Balkans or SME development in North Africa. For a more detailed look at the different institutions, you might be interested in our guide on which MDBs you can work for. By dissecting each bank’s purpose, you stop being a hopeful applicant and become a strategic candidate who knows exactly where they belong.

Understanding the Different Ways to Get In

When people think about working at a European development bank, they usually picture a permanent, lifelong staff job. That’s a common misconception. Getting in isn’t a one-size-fits-all deal. There are several distinct paths you can take, each designed for different career stages and goals.

Figuring out these entry points is your first strategic move. It stops you from blasting your resume at any opening with “European development bank” in the title and helps you focus on what actually fits. This separates serious candidates from the hopefuls.

The Three Main Entry Tracks

Most opportunities fall into one of three buckets: permanent staff, consultants, or structured programs for younger professionals. Each comes with its own set of expectations, rewards, and career paths.

Permanent Staff Roles: This is the classic, long-term career track. These are salaried jobs with full benefits, pensions, and a clear ladder for moving up inside the bank. These are the most competitive roles and almost always demand years of specialized experience.

Consultants and Contractors: These are project-based gigs for experts with very specific skills. A bank might bring on a consultant for six months to figure out if a renewable energy project is viable, or to give technical advice to a government ministry. This path offers flexibility but none of the job security of a permanent role.

Young Professionals Programs (YPPs) and Internships: These are the main gateways for recent grads and people with only a few years of work under their belt. YPPs are hyper-competitive, multi-year rotational programs built to create future leaders. Internships are a shorter-term shot at getting crucial experience and making connections.

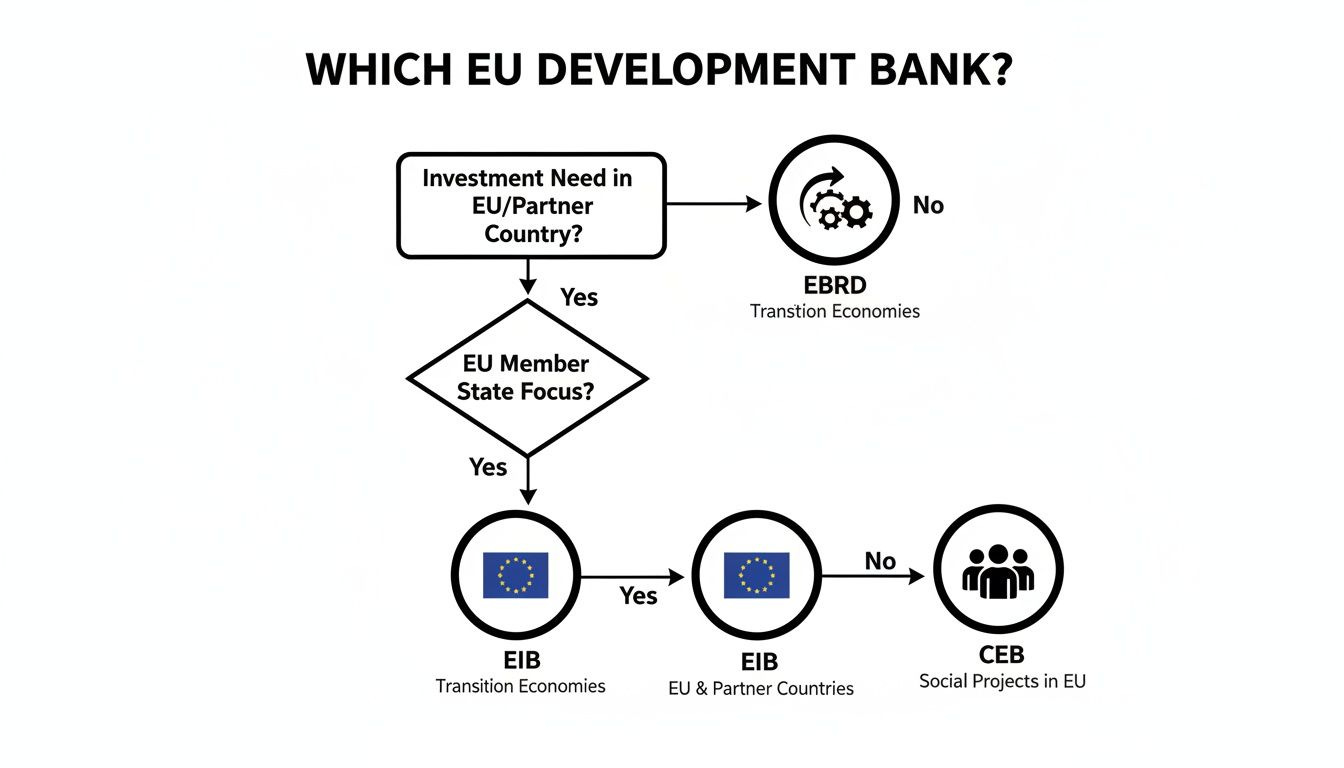

This flowchart breaks down how a bank’s specific mission shapes the kinds of jobs it offers.

As you can see, the starting point is matching what you know, whether that’s transition economics, EU policy, or social development, with the bank that lives and breathes that work.

Permanent Staff: The Long-Term Commitment

For many, landing a permanent role is the ultimate goal. These jobs are the backbone of the bank, covering everything from investment officers and economists to lawyers and HR specialists. Be prepared for a tough hiring process. It often involves multiple interview rounds, technical tests, and formal panel interviews.

The competition is fierce. You aren’t just up against local talent; you’re competing with a global pool of highly qualified people. To even get a look, your resume needs to show a clear, consistent story of success in a field the bank cares about.

The candidates who get these jobs are the ones who show a real commitment to the bank’s mission. They don’t see it as another paycheck; they see a long-term career where they can make a real difference.

The nature of job tenure in development finance has changed since 1995, with economic shifts leading to shorter contracts in some areas. But for those seeking European development bank jobs, key institutions like the EBRD, which has focused on post-1991 reforms in over 30 countries, still need people for the long haul to drive sustainable development. You can get a feel for the historical trends from Eurostat’s annual statistics.

Consultants: The Project-Based Experts

The consultant route is a more flexible way to work with a development bank. Consultants are brought in for their specific, in-demand skills to fill a temporary gap on a project. An assignment could last anywhere from a few weeks to a couple of years.

This path is perfect for seasoned professionals who have a solid network and prefer project-based work. You’re typically paid a daily rate, which can be quite good, but it doesn’t come with the benefits or security of a staff position. It’s a trade-off, and understanding the differences is key. We break it all down in our guide on MDB consultant vs. full-time employee roles.

YPPs and Internships: The Foot in the Door

If you’re early in your career, the Young Professionals Program is the gold standard. These are intense, structured programs designed to fast-track high-potential candidates into leadership roles. Getting in is incredibly difficult, with acceptance rates often below 1%.

Internships are the other critical starting point. They give you a real, firsthand look inside a bank. You’ll learn the culture, build your network, and get a feel for the day-to-day work. A successful internship can dramatically boost your chances of getting a full-time offer or landing a spot in a YPP later on.

Decoding the Non-Negotiables: Nationality and Qualifications

Let’s get straight to it. Before you tailor your resume for a job at a European development bank, you need to clear two massive hurdles first: your passport and your qualifications.

These are hard-and-fast rules. Getting this right from the start will save you time and let you focus on opportunities that are actually open to you.

The first gatekeeper is your nationality. For permanent staff positions, virtually all Multilateral Development Banks (MDBs), including the big European ones, require you to be a citizen of a member country. There’s no wiggle room on this.

These banks are funded and owned by their member countries. Part of that ownership agreement is that the core jobs are reserved for the citizens of those shareholder nations. It’s baked into their DNA.

The Baseline Qualifications You Can’t Fake

Once you’ve cleared the nationality check, you need to meet a baseline of qualifications. Think of this as the price of admission. Without these, your application is dead on arrival, no matter how brilliant your experience is.

These requirements set a high bar, ensuring the banks hire people with proven expertise from day one. They aren’t looking to hire potential; they’re hiring demonstrated skill.

The absolute core requirement is an advanced degree.

Master’s Degree or PhD: For almost any professional role, a Master’s in a relevant field like economics, finance, public policy, or international relations is the bare minimum. A PhD is often a must-have for the more specialized economist or research-heavy positions.

Language Fluency: Professional fluency in English is non-negotiable. For banks like the EIB or CEB, fluency in French is a massive advantage and, for some roles, a firm requirement.

Don’t gloss over the language requirement. “Professional fluency” means you can write a dense technical report, lead a high-stakes negotiation, and present to a board of directors without breaking a sweat. It’s a world away from being conversationally fluent.

Matching Your Experience to the Job Grade

The number of years you’ve been working directly impacts the level of jobs you can realistically apply for. These banks use a structured grading system, and each grade has a clear experience threshold. Applying for a role way above your pay grade is a surefire way to waste your time.

Here’s a rough breakdown of what that looks like:

Analyst/Associate Level: This usually requires 2-5 years of relevant, post-graduate experience. These are the entry-level professional jobs, often snapped up by former top-tier interns or standout young professionals.

Professional/Officer Level: You’ll generally need 5-10 years of solid experience here. This is where most of the hiring happens. At this level, you’re expected to manage parts of projects and operate with a fair amount of autonomy.

Senior/Lead Level: This demands 10+ years of deep, specialized experience, often with a track record of managing teams or leading complex operations. They’re looking for true subject-matter experts.

Internalizing these hard requirements is the single most important first step in your job search. It lets you instantly filter out the jobs you’re not eligible for and pour your energy where it actually counts. This is the insider knowledge that separates a targeted, strategic job hunt from blindly firing off applications into the void.

Finding Openings and Mastering Application Timelines

Knowing where and when to look for a job at a European development bank gives you a massive advantage. Success depends on strategic timing. You need to be watching the right channels long before everyone else catches on.

Most candidates casually browse the main career pages every now and then. A better approach is to treat your job search like an intelligence-gathering mission. You need to know where the live vacancies are posted and, just as importantly, get a feel for the banks’ internal hiring rhythms.

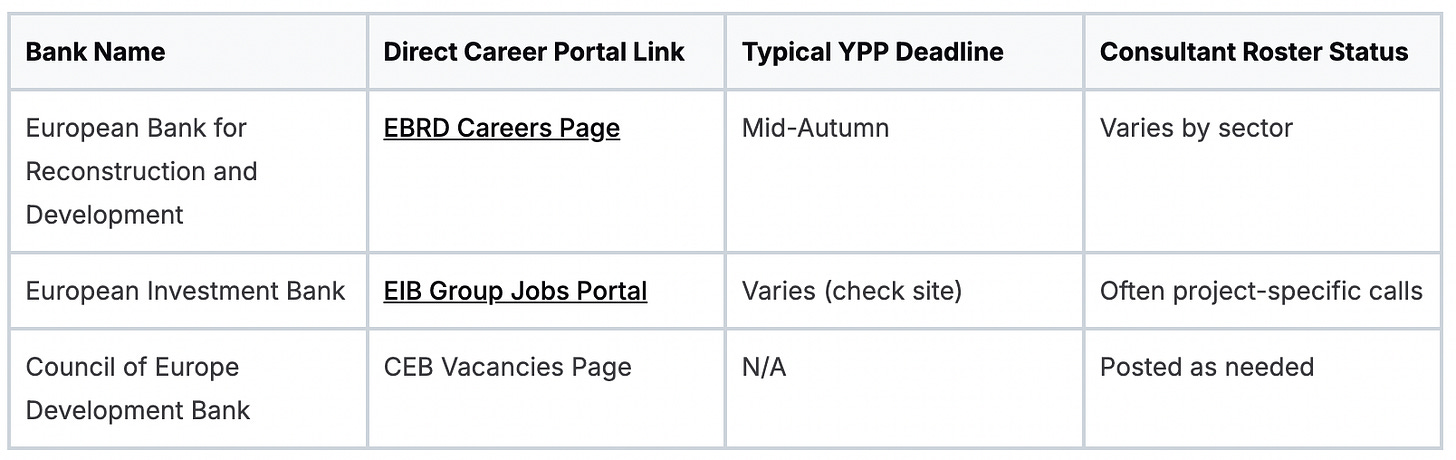

Key Career Portals and Specialized Resources

First, bookmark the official career portals and make a habit of checking them weekly. Don’t rely on third-party job sites, which often have outdated or incomplete listings. You need to go straight to the source.

EBRD Careers: The European Bank for Reconstruction and Development lists everything, staff, consultant, and internship roles, on its central portal.

EIB Jobs: The European Investment Bank Group, which also includes the European Investment Fund (EIF), runs its recruitment through a dedicated jobs site.

CEB Vacancies: The Council of Europe Development Bank posts its openings on its main website, often with very specific and tight application deadlines.

These official sites are your baseline, but they aren’t your only tool. To get an edge, you need resources that pull these opportunities together and give you some insider context. Subscribing to a specialized newsletter, like the Multilateral Development Bank Jobs bulletin, puts curated lists of staff and consultant roles right in your inbox, saving you hours of searching.

Understanding the Hiring Cycles

Development banks operate on their own clock, which is usually much slower and more predictable than the private sector’s. The whole process, from the day you apply to the day you get an offer, can easily take six to nine months. Patience isn’t just a virtue here; it’s a requirement.

Applying for a role at an MDB is a marathon, not a sprint. The long recruitment cycles are thorough, often involving multiple panel interviews, technical assessments, and extensive background checks. Don’t get discouraged by the pace.

This slow tempo is especially true for permanent staff positions. Consultant rosters, on the other hand, can open and close more quickly based on immediate project needs. But the most rigid, non-negotiable deadlines are always attached to the structured entry programs.

Young Professionals Programs (YPPs) have fixed annual application windows, typically opening for just a few weeks in the summer or early fall. If you miss that window, you’re waiting an entire year for the next cycle. Planning your application well in advance is critical. For more on this, check out our insights on how to land an MDB job by mastering their timelines.

This quick-reference guide will help you stay on track.

European Development Bank Career Portals and Key Timelines

This table gives you direct links to the career pages for the major European development banks and a general idea of when to look for their key recruitment programs.

By getting a handle on these timelines and using the right resources, you can sync your job search with the banks’ schedules. This proactive approach ensures you’re applying at the perfect time with a polished application, putting you miles ahead of the competition.

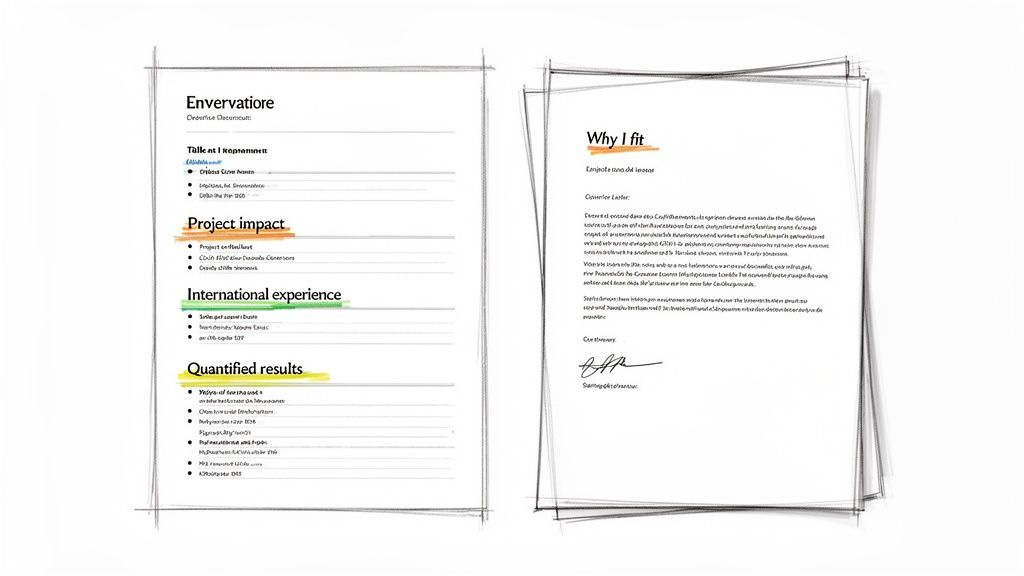

How to Write an MDB-Ready Resume and Cover Letter

Your standard corporate resume will get you nowhere here. Sending one is a classic rookie mistake, and I’ve seen it get otherwise qualified candidates instantly rejected. Recruiters at these European development banks are trained to spot a very specific set of signals. Your job is to make sure your application sends them loud and clear.

Think of your application less as a list of past jobs and more as a compelling case. You need to tell a story that connects your background directly to the bank’s core mission. You’re arguing why you belong in development finance.

Structuring Your MDB Resume for Impact

Your resume needs to scream results, not responsibilities. Recruiters spend seconds scanning each document, and their eyes are trained to hunt for quantifiable impact. They don’t care what you were supposed to do; they want to know what you actually accomplished.

Every bullet point under your work experience must answer the question, “So what?”

Bad Example: “Managed a portfolio of energy projects.”

Good Example: “Managed a $50M portfolio of renewable energy projects, leading to the financing of 3 solar farms that now power 100,000 homes.”

The second version gives them scale, specifics, and a tangible outcome. That’s what makes a recruiter stop scrolling.

Your resume is an evidence-based document. Every claim you make should be backed by a number, a percentage, a dollar amount, or a concrete outcome. Vague statements are a red flag for recruiters.

Also, you have to embed keywords from the job description. These banks use Applicant Tracking Systems (ATS) to do the first round of filtering. A human might not see your resume if the machine doesn’t find the right terms. Print out the job description, highlight the key skills and competencies, and make sure those exact phrases are woven into your application.

Mastering the STAR Method

For structuring your resume bullet points, the STAR method (Situation, Task, Action, Result) is the gold standard. It forces you to get straight to the point and focus on outcomes.

Situation: Briefly set the context. What was the challenge?

Task: What was your specific responsibility in that scenario?

Action: What concrete steps did you take? Use strong, active verbs.

Result: What was the measurable outcome of your actions?

Here’s what it looks like in practice:

Situation: A government client in Eastern Europe needed to modernize its urban transport infrastructure but was struggling to secure funding.

Task: My role was to assess project feasibility and structure a financing model that would attract private investment.

Action: I conducted full due diligence, built a financial model projecting a 15% IRR, and presented the investment case to key stakeholders.

Result: This work directly secured €200M in blended finance, launching a project that ultimately reduced city commute times by 25%.

This level of detail is non-negotiable. It proves you understand the project cycle and that you deliver results people can measure.

Writing a Compelling Cover Letter

Do not just summarize your resume in your cover letter. That’s a wasted opportunity. This is your one chance to articulate your “why.” Why this particular bank? Why its mission? Why are you the perfect person for this specific job?

Start by directly referencing the bank’s mission and mentioning a recent project or report they published. It’s a simple move that immediately shows you’ve done your homework and have a genuine interest.

From there, build a clear narrative. Pick two or three of your proudest professional achievements and connect the dots for them. Don’t just restate what’s in your resume; expand on those experiences, explaining how they have prepared you for the precise challenges of the role you’re targeting.

Finally, close with a confident statement about the value you know you can bring to the team. Your goal is to transform your application from a dry list of qualifications into a compelling argument for why they have to call you for an interview. It’s your story. Make it a powerful one.

Preparing for the Interview and Next Steps

Your application got you in the door. That’s a huge win, so take a moment to appreciate it. Now, it’s time to gear up for the rigorous, multi-stage interview process that these top-tier institutions are known for. This isn’t about memorizing answers; it’s about showing them how you think.

The interview process at a European development bank tests two things: your technical skills and your behavioral fit. They need to know you can do the job and, just as importantly, that you can do it within their unique, mission-driven culture. Getting through takes serious prep.

Acing the Competency-Based Interview

Most of these banks lean heavily on competency-based or behavioral interviews. The logic is simple: past performance is the best predictor of future behavior. You won’t get many hypothetical “what would you do if...” questions. Instead, they’ll ask you to pull specific, real-world examples from your past.

Expect questions that start with phrases like:

“Tell me about a time when you had to manage a difficult stakeholder.”

“Describe a situation where you had to analyze a complex set of data to make a recommendation.”

“Give an example of a project that failed and what you learned from it.”

Your secret weapon here is the STAR method we covered for your resume. For every core competency listed in the job description (teamwork, client orientation, problem-solving), prepare at least two detailed stories from your career. Write them down and practice telling them out loud until they’re sharp, concise, and powerful.

Preparing for the Technical Deep Dive

Beyond the behavioral questions, you will face a technical interview. This is where they pop the hood and make sure you know your stuff. If you’re going for an economist role, get ready to be grilled on macroeconomic theory. For an investment officer position, they’ll put your financial modeling skills to the test.

There are no shortcuts here. You have to be an expert in your field. Dust off the textbooks, review the fundamentals, and be ready to apply your knowledge to a case study that’s relevant to the bank’s work. The EIB, for example, might hand you a case about financing a massive renewable energy project in an EU member state.

The real goal of the technical interview is to see your thought process in action. They want to know how you arrive at an answer, not just that you know it. Talk them through your assumptions, your logic, and your analytical steps.

Deepening Your Sector Knowledge

The people who get these jobs are genuinely plugged into the development sector. Your interviewers will expect you to have a sophisticated, up-to-date understanding of the challenges and opportunities in the regions where the bank operates.

Stay current on industry trends and prove you’re invested in the space. A fantastic way to do this is by subscribing to specialized resources. The Multilateral Development Bank Jobs newsletter is an excellent tool, not just for spotting openings, but for staying informed on the sector-wide news and analysis that provides crucial context for your interviews.

This final stage is all about proving you’re the complete package. You need the technical chops, the right behaviors, and a real commitment to the mission. Walk into that interview ready to show all three, and you’ll be in the strongest possible position to land an offer for a top European development bank job.

Common Questions About MDB Careers

Let’s tackle some of the questions that always come up about careers at Europe’s development banks. Getting straight answers can help you decide if this path is really for you.

What’s the Pay Really Like?

The compensation at these banks is seriously competitive, designed to pull in experts from all over the world. A key detail is that salaries are often tax-free for most nationalities and are benchmarked against other international financial institutions, not what a local private bank in Frankfurt or London might offer.

While the exact numbers change depending on your grade and location, you can expect a package with a strong base salary plus generous benefits. We’re talking comprehensive health insurance, solid pension plans, education grants for your children, and help with relocation costs.

Is There Any Work-Life Balance?

It’s demanding, but it’s generally more predictable than the grind of investment banking or top-tier management consulting. For staff in operations, things can get intense with project deadlines and travel for missions. You will work hard, and long hours are part of the deal when you’re trying to close a major financing or you’re out in the field.

That said, the culture has a healthier respect for personal time than you’d find in purely commercial jobs. You get a good amount of annual leave, and the banks focus on making sure their staff can stick around for the long haul. It’s a marathon, not a sprint, and they treat it that way.

Keep in mind that the intensity really depends on the role. A banker at the EIB pushing live infrastructure deals will have a completely different daily rhythm than a policy advisor at the CEB. The job dictates the pace.

What Does a Career Path Look Like?

Career progression is structured and clear. The banks use a formal grading system, and getting promoted is tied to your performance reviews and institutional needs. Moving up the ladder usually means taking on more complex projects, managing bigger teams, or becoming the go-to expert in your niche.

Internal mobility is also a big part of the culture. It’s common for staff to move between different departments, sectors, or even country offices every few years. This is a huge plus, as it lets you build a diverse skill set all within one organization, paving the way for a rich and varied long-term career.

Ready to get ahead of the competition? The Multilateral Development Bank Jobs newsletter delivers curated staff and consultant openings from over 30 MDBs directly to your inbox every week, along with insider guides to help you land the role. Subscribe to Multilateral Development Bank Jobs.