What does the new US report on MDBs say?

Takeaways for the World Bank, ADB, AfDB, IMF, and more.

Hi everyone,

For those who are on the hunt for jobs at MDBs (which I’m guessing might be you), make sure you subscribe to the paid plan to get the freshest job listings each Monday, so you can apply early and track them down before they disappear.

If you’re wondering what’s in these emails, job listings dated 28 July, 2025 or older are now freely accessible. You can check out the most recent unlocked post here.

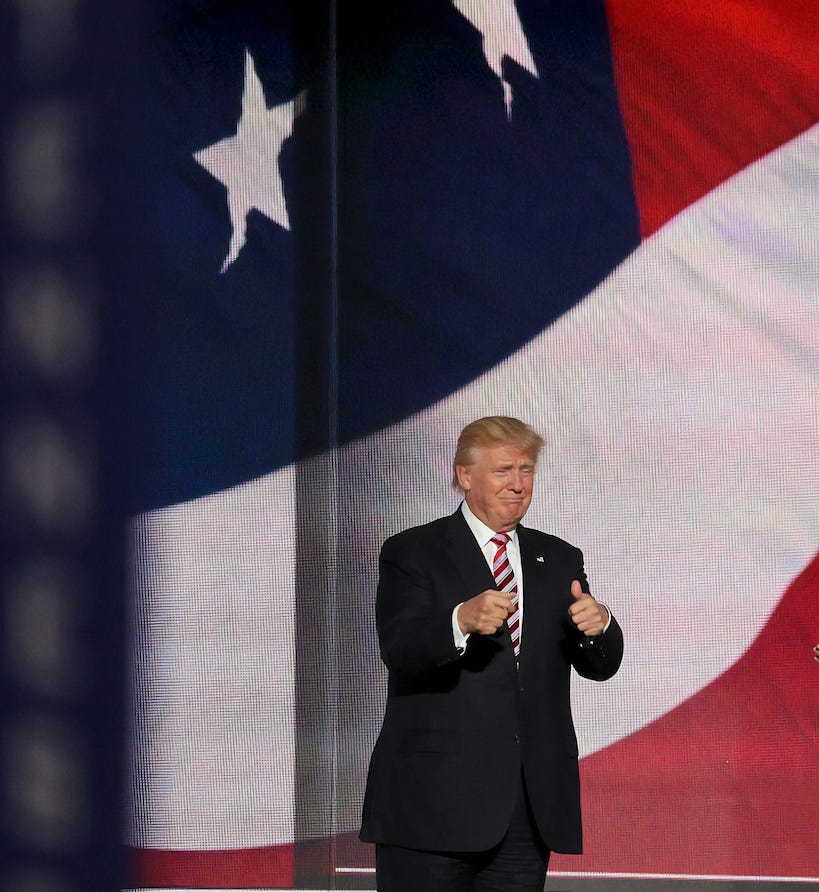

The National Advisory Council on International Monetary and Financial Policies of the US recently released a report to Congress on Multilateral Development Banks. This essentially sets out the Trump Administration’s approach to MDBs.

It’s a long and dry read, but there are some interesting bits about what the administration is prioritising, and what it means for the future of MDBs.

Here’s the breakdown.

Why MDBs Matter Under Trump

The Trump administration sees MDBs as tools to boost U.S. economic and security goals without draining taxpayer dollars. In 2024, the MDBs where the U.S. holds shares like the World Bank Group, African Development Bank, Asian Development Bank, European Bank for Reconstruction and Development, Inter-American Development Bank Group, and North American Development Bank dished out $167 billion in financing to developing countries.

But make no mistake, that's not charity. It's essentially an investment that opens markets for U.S. exports, creates contracts for American firms, and counters what the report refers to as ‘opaque lending’ from players like China.

U.S. contributions get amplified big time. Take the non-concessional windows: $9.2 billion from the U.S. since 1944, enabled over $2.4 trillion in commitments. The admins's committed to keeping MDBs laser-focused on core missions:

slashing poverty,

fueling private sector growth, and

expanding energy access via an all-of-the-above strategy.

That means supporting gas, renewables with backups, and even nuclear where it fits. This essentially means no more rigid green mandates.

As the biggest or joint-biggest shareholder in most MDBs (second in AfDB), the U.S. calls the shots on reforms. They're pushing for transparency, debt sustainability, and projects that build self-reliance, reducing the need for endless aid.

Standout Wins from 2024

According to the report, last year showed MDBs delivering on U.S. priorities. Here's the rundown:

Private Sector Push: MDBs mobilized nearly $98 billion in private capital in 2023 (latest data), upping tools to crowd in investors and cut foreign exchange risks. This creates jobs and cuts aid dependency.

Infrastructure That Counts: $50 billion in approvals, over 30% of total financing. Beyond cash, MDBs prep projects for private bids, build government capacity, and vet for risks. U.S. firms win here: better roads, ports, and grids mean more export markets.

Energy Done Right: MDBs back affordable, reliable power. Generation, transmission, and reforms. The report says they're steering MDBs toward tech-neutral choices, like gas or renewables with intermittency fixes, to drive growth and U.S. tech sales.

Procurement Overhaul: Billions in contracts annually, and the report claims it’s helping MDBs reform to favor quality over cheap bids. That levels the field against subsidized state-owned enterprises, especially Chinese ones, and boosts U.S. business outreach.

Risk Smarts: Stronger due diligence on forced labor in renewables and cybersecurity in digital projects. This protects investments and aligns with U.S. standards.

Crisis Response: MDBs stepped up for Ukraine ($42 billion from World Bank, $4 billion from EBRD) and poorest countries ($39 billion concessional financing). Replenishments like IDA-21 and AsDF-14 locked in support for fragility, debt management, and growth.

Performance varied by bank: World Bank hit $99 billion in commitments, with IFC mobilizing a record $22.5 billion. AfDB approved $11 billion, focusing on infrastructure. ADB reached $24.3 billion, emphasizing the private sector in frontier spots. EBRD invested $17.9 billion, heavy on private deals. IDB Group did $14.4 billion, scaling private mobilization. NADB focused $362 million on what it calls ‘Border Environment Infrastructure’.

2025 Priorities: Where the Action Is

The admin's doubling down to trim bloat and amp results. Expect these to shape MDB agendas:

Energy Access First: Push all-of-the-above strategies, prioritizing affordability and including nuclear. For World Bank, ADB, EBRD, and IDB, this means dropping bans on certain fuels and focusing on supply chains outside China for critical minerals.

Private Sector Dominance: More coordination between public and private arms (like World Bank and IFC) to smash investment barriers. Targets include $13 billion in ADB private financing by 2030, with half in tough markets. For IDB Invest, a new $3.5 billion capital boost aims for $100 billion in long-term financing over 10 years, half mobilized privately.

Procurement Fair Play: Mandate value-for-money bids, engage U.S. firms more (via Commerce Dept.), and scrutinize state-owned enterprises. Block firms aiding Russia's Ukraine invasion from reconstruction contracts.

China Check: End lending to China across the board. Apply graduation policies strictly to redirect to poorer countries. Bolster alternatives to Chinese debt, emphasizing transparency.

Debt and Accountability: Incentivize better debt management, publish data, and resource oversight units. For IFAD, monitor $3.5 billion program delivery and explore balance sheet tweaks.

Efficiency Reigns: Restrain budgets and salaries, focus on impact metrics, and update safeguards/accountability (e.g., World Bank's mechanism restructure, AsDB's new framework).

U.S. efforts reviewed 1,550 projects for quality, improved transparency on intermediary loans, and boosted aid to fragile spots.

What This Means for Your MDB Career

If you're looking for a spot like analyst, project manager, or policy role, align with these shifts.

MDBs need high quality people who understand private sector dynamics, energy realities, and risk mitigation.

Make sure you subscribe to MDB Jobs to get the latest vacancies delivered straight to your inbox each Monday.