Funding Cuts Hit International Development: What It Means for MDB Jobs

Multilateral Development Banks are not the same as the UN or NGOs

Right now, with major cuts from the US and UK, the entire international development sector is chaos.

But let's break it down clearly: multilateral development banks (MDBs) like the World Bank or African Development Bank operate differently from NGOs or the UN.

This difference gives MDBs a bit more stability, even in tough times. I'll explain the mechanics, the cuts, and what this means for jobs going forward.

If you're eyeing a role in this field, focus on building skills in areas like private sector mobilization. These look like they’ll be in demand in the short-term.

How MDB Funding Actually Works

MDBs function as banks, not just aid distributors.

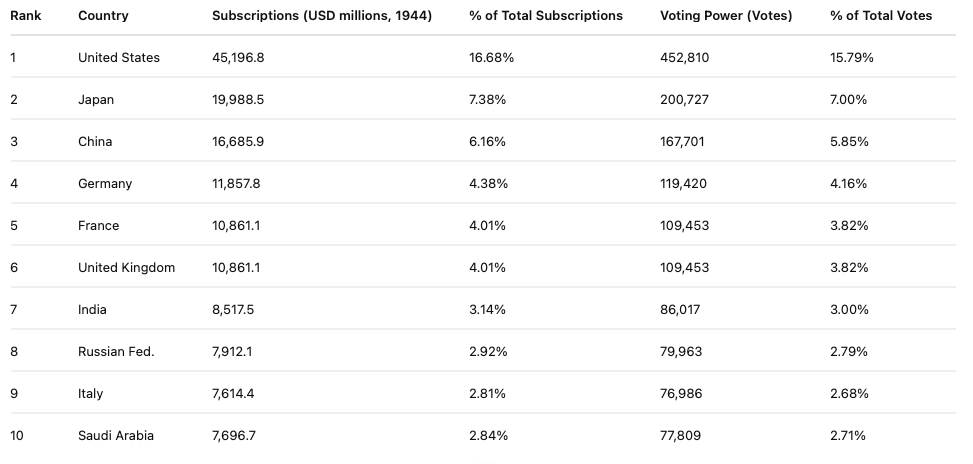

Member countries provide capital subscriptions, which act as a base for operations. This lets MDBs borrow money cheaply from global markets and lend it out to developing nations for projects in infrastructure, health, or education. They also issue bonds and attract private investors through guarantees or co-financing.

For example, the World Bank relies on these subscriptions and market borrowings to fund over $100 billion in commitments annually. This setup creates a multiplier effect: one dollar from governments can leverage three or more from other sources.

Unlike straight aid, MDBs generate returns on loans, recycling capital for future use. This self-sustaining model reduces reliance on yearly donor whims.

Key Differences from UN and NGO Funding

The UN gets most of its money from assessed contributions. These are mandatory payments based on a country's economy, and voluntary pledges from donors. These can fluctuate wildly with political shifts, making budgets unpredictable. NGOs depend even more on grants from governments, foundations, or public donations, often tied to specific projects with short timelines.

MDBs stand apart because their capital base and borrowing power provide a buffer. While UN agencies or NGOs might see direct hits from aid cuts, MDBs can tap markets or mobilize private funds to fill gaps.

In practice, this means MDB projects continue even if one big donor pulls back, as long as overall credit ratings stay strong. Which, for now, seems like it’s the case.

US and UK Cuts: The Current Reality

In 2025, both the US and UK have slashed international aid budgets. The US, under President Trump, proposed a FY2026 budget cutting foreign aid by nearly 48% to $31.2 billion, including a 20% reduction to the World Bank's International Development Association (IDA)

USAID staff has shrunk dramatically, down to just 15 positions, with operations folding into the State Department.

There's even talk of US withdrawal from the World Bank, per Project 2025 plans. But I doubt this will actually happen (based on this year’s spring meetings).

The UK, facing defence priorities, cut aid from 0.5% to 0.3% of gross national income starting in 2027. This is a 40% drop worth about £6 billion. This includes reviewing pledges to MDBs like IDA, adding uncertainty.

These moves reflect broader trends: donors redirecting funds amid domestic pressures, hitting global aid hard.

Will These Cuts Hammer MDBs?

Yes, they’ll be affected. But not as severely as you might think. MDBs will feel the pinch. Reduced contributions mean less concessional lending for the poorest countries.

The World Bank has held internal discussions on risks like US withdrawal, which could shake confidence and raise borrowing costs.

Still, their diversified funding helps. They can ramp up private sector involvement or adjust portfolios to prioritize high-impact areas like addressing armed conflict, where demand stays high.

In contrast, NGOs and UN agencies face steeper drops. Global humanitarian funding fell by a third in 2025, forcing cuts across the board.

Job Market Outlook: Turbulence Ahead, But MDBs Hold Steady

The international development job market took a hit in early 2025, with up to 50,000 US-based roles lost due to USAID cuts rippling through partners.

NGOs shed staff massively. Think 30% workforce reductions at places like the World Food Programme.

The UN slashed thousands of jobs, including 3,500 at UNHCR, and faces a 20% budget cut for 2026.

Hiring dropped 43% on UN platforms, making the sector more challenging than ever.

For MDBs, the picture looks better. While some hiring slows, their stable funding sources mean fewer outright layoffs. Jobs in areas like sustainable finance or digital infrastructure remain in demand, as MDBs pivot to attract private capital

Expect roles focused on private sector development to grow, even if overall headcount holds flat.

And you might see a few less positions related to climate and the environment advertised - as the new US administration isn’t too keen on this…

How MDB Jobs Stack Up Against NGO and UN Roles

NGO jobs offer hands-on impact but come with instability. Funding cycles mean frequent contract renewals and sudden cuts, as seen this year.

UN positions provide prestige and benefits, but bureaucracy and donor dependence lead to freezes; expect more short-term gigs.

MDB roles edge them out in the current climate.

They combine technical depth with better job security, thanks to that banking model. Salaries often beat NGOs, and career paths lead to private sector opportunities.

If you're transitioning, target MDB entry points like young professionals programs. They value expertise in data analysis or project finance.

Moving Forward: Stay Adaptable and Optimistic for MDBs

The sector won't rebound overnight, but MDBs have tools to weather this storm better than NGOs or the UN. By leaning on markets and partnerships, they can sustain operations and jobs.

If you're in the field, diversify your skills. You can learn about blended finance or private sector development to make yourself indispensable.

For those entering, MDBs still offer a solid bet. And as you’ll see from our weekly job posting newsletters, there are still hundreds of jobs going for MDBs each week.

Make sure you subscribe to MDB Jobs to get the latest vacancies delivered straight to your inbox each week.